Roxgold Reports Fourth Quarter and Full Year 2020 Results

TORONTO–(BUSINESS WIRE)–Roxgold Inc. (“Roxgold” or the “Company”) (TSX: ROXG) (OTCQX: ROGFF) today reported its fourth quarter and full year financial results for the period ended December 31, 2020.

For complete details of the audited Consolidated Financial Statements and associated Management’s Discussion and Analysis please refer to the Company’s filings on SEDAR (www.sedar.com) or the Company’s website (www.roxgold.com). All amounts are in U.S. dollars unless otherwise indicated.

Full Year 2020 Highlights:

During the year ended December 31, 2020, the Company:

Operations

- Produced 133,940 ounces of gold at an average grade of 8.49 grams per tonne in 2020 – exceeding the upper end of annual gold production guidance of 130,000 ounces.

- Achieved cash operating costs of $579 per ounce within the annual cost guidance range of $520 to $580 per ounce.

- Processed a record annual throughput of 512,276 tonnes exceeding nameplate capacity by 27%.

- Reported an interim Mineral Reserves and Resources estimate at Yaramoko with total Proven and Probable Mineral Reserves increasing by 8% to 710,000 ounces of gold more than replacing depletion of 207,396 ounces during the period from December 31, 2018 to June 30, 2020. Measured and Indicated Mineral Resources increased 4% to 857,000 ounces of gold.

Financial

- Sold 135,310 ounces of gold for a total of $239.7 million in gold sales in 2020 (140,800 ounces1 and $196.2 million1 respectively in 2019).

- Achieved adjusted EBITDA2 of $108.8 million in 2020 compared to $83.3 million in 2019.

- Generated cash flow from mining operations2 totalling $126.2 million for cash flow from mining operations per share2 of $0.34 (C$0.45/share).

- Strong free cashflow (before growth spend)3 of $47.8 million increasing the cash balance by $20.1 million to $61.9 million.

- Strengthened the balance sheet ending the year with a cash balance of $61.9 million and net cash position of $27.3 million.

- Adjusted net income2 of $38.8 million or $0.10 per share (C$0.14/share); compared to $19.5 million or $0.05 per share (C$0.07/share) in 2019.

- Produced a mine operating margin2 of $1,079 per ounce in 2020.

- Generated a strong return on equity2 of 20% in 2020.

Growth

- Received Exploitation (mining) permit and Environmental approvals from the government of Côte d’Ivoire to develop and operate the Séguéla Gold Project.

- Expanded Séguéla Gold Project with discovery of the Koula deposit and an updated Mineral Resource estimate outlining total indicated mineral resources of 1,044,000 ounces of gold at 2.5 grams per tonne (“g/t”) and inferred mineral resources of 370,000 ounces at 4.8 g/t.

- Commenced an infill drilling program at Koula with initial results such as 14m at 42.9 g/t from 61 metres down-hole in SGRD1000, 11m at 46.2 g/t Au from 48 metres down-hole in SGRC799, and 18m at 22.1 g/t Au from 175 metres down-hole in SGRD800, continue to emphasise the high grade nature of the deposit.

- Commenced early works at Séguéla to enable a rapid ramp up to full construction in 2021 following completion of the Feasibility Study which is anticipated for completion in the second quarter of 2021.

- Repurchased a 0.3% Net Smelter Royalty on Séguéla from an original property owner, exercising the right of first refusal to pre-empt an arms-length acquisition between the property owner and an international royalty company for consideration of $0.7 million cash. Séguéla continues to have a 1.2% NSR held by another original property owner under similar terms including a right of first refusal and a right to acquire the remaining royalty for fair market value after a decision to mine has been made.

- Tested additional mineralization corridors at Boussoura which targeted the vein corridors to the west of Fofora Main including a new VC2 prospect with results such as 14m at 3.6g/t Au from 44m in BSR-20-RC-FFR-134, 5m at 17.0 g/t Au from 59m in BSR20-RC-FFR142 and 23m at 2.0g/t Au from 41m in BSR-20-RC-FFR-143.

Safety

- Maintained an industry-leading Lost Time Injury Frequency Rate (LTIFR) per 1,000,000hrs of 0.37 for 2.69 million man-hours, including one lost time incident for the 12-month period. This was the first LTI incident at Yaramoko since September 2018.

- Continued management of the current global COVID-19 crisis with operations at Yaramoko not materially impacted with heightened preventative measures and response plans in place to mitigate and minimize any potential impacts. Operations continue to operate with reduced personnel due to COVID-19 travel restrictions and protection protocols. The Company is continually assessing the health and safety risks to the Company’s personnel and contractors at its operations and offices.

“Looking back on 2020, Roxgold was able to rise to the challenge of global events by delivering remarkably strong operating and financial results while advancing the near-term growth potential of the company and ensuring the safety and security of our teams and the communities in which we operate,” commented John Dorward, President and CEO of Roxgold. “Roxgold is well on the road towards becoming the West Africa’s next multi-asset gold producer. The Séguéla Gold Project in Côte d’Ivoire is expected to start construction this year, which has the potential to more than double our production, reserve base, cash flows, and earnings – whilst giving Roxgold further diversification to meet the growing appetite of the investment community.

“The Yaramoko Gold Complex once again delivered strong operating results in 2020, with gold production of 133,940 ounces at cash operating costs of $579 per ounce, exceeding our annual production guidance for the year. Yaramoko continues to be the cashflow engine for this company, as we generated cash flow from mining operations of $126.2 million, achieved adjusted net income of $38.8 million, and reported a return on equity of 20% enabling us to strengthen our balance sheet to end the year with a cash balance of $61.9 million. Since starting production in 2016, Yaramoko has produced over 610,000 ounces of gold and, as the recent resource update highlighted, continues to demonstrate its ability to replace production and maintain a long mine life.

“Our strong balance sheet has enabled us to continue to invest in our growth projects with significant advancement at Séguéla delivered through the hard work of our exploration and project teams, growing in scale with the discovery of the high-grade Koula deposit and an updated Mineral Resource estimate outlining total indicated mineral resources of 1,044,000 ounces of gold at 2.5 grams per tonne (“g/t”) and inferred mineral resources of 370,000 ounces at 4.8 g/t. This project was acquired for just $20 million in 2019 and we are eager to share with the market the results of the upcoming Feasibility Study in the second quarter, which we believe will make material improvements upon the already robust Preliminary Economic Assessment announced in April 2020 with an after-tax NPV of $344 million and 81% IRR at $1,650/oz gold. Finally, during the year we also announced a new high-grade discovery at the Boussoura Project in the southern portion of the Houndé Greenstone Belt in southern Burkina Faso. Since then, we have drilled over 150 holes at Boussoura with consistent assay returns demonstrating broad intersections of mineralization.”

2020 Quarterly & Annual Highlights

|

| Three months | Three months | Year ended | Year ended |

|

|

|

|

|

|

| Gold ounces produced | 35,191 | 41,162 | 133,940 | 142,204 |

| Gold ounces sold1 | 38,504 | 40,700 | 135,310 | 140,800 |

|

|

|

|

|

|

| Financial Data (in thousands of U.S. dollars) |

|

|

|

|

| Gold sales1 | 72,155 | 60,208 | 239,686 | 196,151 |

| Mine operating profit4 | 27,955 | 20,423 | 88,381 | 60,920 |

| EBITDA2 | 31,224 | 24,743 | 94,857 | 69,410 |

| Adjusted EBITDA2 | 34,333 | 26,993 | 108,760 | 83,262 |

| Adjusted EBITDA margin2 | 48% | 45% | 45% | 43% |

| Net income | 9,917 | 4,761 | 24,901 | 5,663 |

| Basic earnings per share attr. to shareholders | 0.02 | 0.01 | 0.05 | 0.01 |

| Adjusted net income2 | 13,205 | 7,011 | 38,804 | 19,515 |

| Per share2 | 0.04 | 0.02 | 0.10 | 0.05 |

| Cash flow from mining operations2 | 39,261 | 30,660 | 126,151 | 98,339 |

| Per share2 | 0.11 | 0.08 | 0.34 | 0.27 |

| Return on equity2 | 20% | 11% | 20% | 11% |

| Cash on hand end of period | 61,878 | 41,780 | 61,878 | 41,780 |

| Total assets | 343,547 | 291,683 | 343,547 | 291,683 |

|

|

|

|

|

|

| Statistics (in dollars) |

|

|

|

|

| Average realized selling price (per ounce) | 1,874 | 1,479 | 1,771 | 1,393 |

| Cash operating cost (per tonne processed)2 | 152 | 146 | 152 | 149 |

| Cash operating cost (per ounce produced)2 | 553 | 466 | 579 | 489 |

| Total cash cost (per ounce sold)2 | 682 | 576 | 692 | 568 |

| Sustaining capital cost (per ounce sold)2 | 180 | 269 | 262 | 216 |

| Site all-in sustaining cost (per ounce sold)2 | 862 | 845 | 954 | 784 |

| All-in sustaining cost (per ounce sold)2 | 908 | 914 | 1,004 | 844 |

2020 In Review

Production

At Yaramoko, we continued to see strong operating performance and cashflow generation. Yaramoko produced 133,940 ounces of gold exceeding the upper end of guidance of 130,000 ounces and processed a record 512,276 tonnes at an average head grade of 8.5 g/t and mill recoveries of 98.1%.

Cash operating & All-in sustaining costs

Cash operating cost2 of $579 was within the guidance range of $520 to $580 per ounce. All-in sustaining cost2 of $1,004 was slightly above guidance range of $930 to $990 per ounce sold primarily due to the following reasons:

- Reduced mining activities at Yaramoko as it continued to operate with reduced personnel due to COVID-19 travel restrictions and protection protocols. Throughput levels were maintained as the processing plant was supplemented with 84,911 tonnes of low-grade stockpile at an average grade of 2.89 g/t processed. The cash cost impact of processing the lower grade stockpiled material was $35 per ounce sold.

- The higher average realised gold price of $1,771 per ounce also increased royalty payments by $19 per ounce sold compare to guidance assumptions.

Total mine operating expense for the year ended December 31, 2020 include $3.0 million for COVID-19 costs, which reflects incremental costs, primarily related to personnel, camp and transportation costs. These costs are excluded from per ounce cost metrics.

We continued to strengthen our balance sheet ending the year with approximately $61.9 million in cash and in a net cash position of $27.3 million. The company also has an additional US$20 million as a revolving credit facility that remains unutilized at the end of the year.

Growth

The Company has had an exceptional year in progressing the Séguéla Gold Project, extending the mine life at Yaramoko and the discovery of Boussoura.

Séguéla Gold Project

- Received Exploitation (mining) permit and Environmental approvals from the government of Côte d’Ivoire to develop and operate the Séguéla Gold Project in Q4 2020

- Expanded Séguéla Gold Project with discovery of the Koula deposit and an updated Mineral Resource estimate outlining total indicated mineral resources of 1,044,000 ounces of gold at 2.5 grams per tonne (“g/t”) and inferred mineral resources of 370,000 ounces at 4.8 g/t

- Commenced infill drilling program at Koula with initial results such as 14m at 42.9 g/t from 61 metres down-hole in SGRD1000, 11m at 46.2 g/t Au from 48 metres down-hole in SGRC799, and 18m at 22.1 g/t Au from 175 metres down-hole in SGRD800, continue to emphasise the high grade nature of the deposit

- Commenced early works at Séguéla to enable a rapid ramp up to full construction in 2021 following completion of the Feasibility Study which is anticipated for completion in the second quarter of 2021

- Repurchased a 0.3% Net Smelter Royalty on Séguéla from an original property owner, exercising the right of first refusal to pre-empt an arms-length acquisition between the original property owner and an international royalty company for consideration of $0.7 million cash. Séguéla continues to have a 1.2% NSR held by another original property owner under similar terms including a right of first refusal and a right to acquire the remaining royalty for fair market value after a decision to mine has been made.

Yaramoko Mine Complex

Reported an interim Reserves and Resources estimate at Yaramoko with total Proven and Probable Mineral Reserves increasing by 8% to 710,000 ounces of gold replacing depletion of 207,396 ounces during the period from December 31, 2018 to June 30, 2020. Measured and Indicated Mineral Resources increased 4% to 857,000 ounces of gold increasing the mineral endowment of Measured and Indicated Mineral Resources plus cumulative production to date at Yaramoko to 1.5 million ounces.

Boussoura

On February 3, 2020, the Company announced a new high-grade discovery at Galgouli, and excellent results following up historic drilling at Fofora at the Boussoura Project in the southern portion of the Houndé Greenstone Belt in southern Burkina Faso. During the year, over 150 holes have been drilled with consistent assay returns demonstrating broad intersections of mineralization with lower grade halos surrounding higher grade quartz veins – characteristic of the style of mineralization found within the prolific Houndé Gold Belt.

2021 Production and Cost Guidance

- Gold production between 120,000 and 130,000 ounces

- Cash operating cost2 between $580 and $640/ounce

- All-in sustaining cost2 between $895 and $975/ounce

- Sustaining capital spend between $25 to $30 million

- Non-sustaining capital spend of $5-$10 million

- Growth spend (includes Exploration and Séguéla study spend) of $15-$20 million

Roxgold anticipates the Yaramoko Mine Complex will produce between 120,000 and 130,000 ounces in 2021 with cash operating costs of $580–640/oz and all-in sustaining costs (“AISC”) of $895–975/oz. Sustaining capital is expected to decline this year compared to 2020 due to the completion of decline development at Bagassi South, allowing the operation to focus on stoping operations. The higher gold price increased the impact of royalties by approximately $30/oz.

The production and cost guidance assumes no material operational impacts due to COVID-19. A prolonged COVID-19 related delay or significant deterioration in operating conditions may have an impact on production and cost guidance.

Response to the COVID-19 Pandemic

Management of the current global COVID-19 crisis is ongoing particularly as various jurisdictions implement measures to re-open or close again, their economies. The Company has been proactive in its response to the potential threats posed by COVID-19 and has implemented a range of measures to protect the health and well-being of its employees and host communities while continuing to operate to the extent possible, in ordinary course of business. These measures include, but not limited to, quarantine, reducing on-site crew sizes, enhanced cleaning and disinfecting protocols, requiring workers with symptoms to self isolate and promoting preventative measures including social distancing and frequent handwashing. All employees returning to site are required to complete a testing and screening process. As a result, operations at Yaramoko to date have not been materially impacted by COVID-19. The Company is continually assessing the evolving situation, including the health and safety risks to the Company’s personnel and contractors at its operations and offices.

Whilst production at Yaramoko has been maintained, if a prolonged COVID-19 related interruption were to occur it may have an impact on the Company’s operations, financial position and liquidity. The Company has strengthened its liquidity position in the quarter with its cash increasing to $61.9 million and unutilised revolving credit facility totalling $20 million.

Review of Annual 2020 Financial Results

Mine operating profit

During the year ended December 31, 2020, revenues totalled $239.7 million (2019 – $182.0 million) while mine operating expenses and royalties totalled $81.9 million (2019 – $59.9 million) and $14.4 million (2019 – $10.0 million), respectively. The increase in sales is primarily due to a 27% increase in the average realized gold price, offset by an 4% decrease in ounces sold. Total mine operating expenses included $3.0 million COVID-19 related costs reflecting incremental costs, primarily relating to personnel, camp and transportation costs. During the year, the Company achieved total cash cost2 per ounce sold of $692 and a mine operating margin2 of $1,079 per ounce sold.

For more information on the cash operating costs2 see the financial performance of the Mine Operating Activities section of the Company’s Management’s Discussion and Analysis (“MD&A”) that is available on the Company’s website at www.roxgold.com and on SEDAR at www.sedar.com.

During 2020, mine operating expenses totalled $81.9 million compared to $59.9 million in 2019. Mine operating expenses increased in 2020 as Bagassi South achieved commercial production in September 2019. In 2019, pre-commercial mine operating expenses of $9.4 million were capitalized to property, plant and equipment.

During 2020, depreciation totalled $55.0 million compared to $51.1 million in 2019. The increase in depreciation is a result of the continued investment in the underground development of 55 Zone and Bagassi South combined with higher throughput.

General and administrative expenses

General and administrative expenses for 2020 were $5.6 million compared to $5.4 million in 2019.

Sustainability and other in-country costs

Sustainability and in-country costs totalled $1.6 million for the year ended December 31, 2020, respectively compared to $3.0 million in the comparative period. The decrease in expenditures primarily relates to timing of community investments in 2020 which were impacted by COVID-19. These expenditures are incurred as part of Roxgold’s commitment to responsible operations in Burkina Faso including several sustainability and community projects.

Exploration and evaluation expenses (“E&E”)

Exploration and evaluation expenses totalled $29.6 million in 2020 compared to $16.1 million in 2019. The significant increase in exploration and evaluation activities was primarily due to the advancement of the feasibility study at the Séguéla Gold Project expected to be released in the second quarter of 2021. There was also drilling at the Boussoura project in Burkina Faso.

E&E expenses totalled $21.4 million at the Séguéla Gold Project and $8.9 million for Boussoura and Yaramoko in 2020. Expenditures at the Séguéla Gold Project included $15.0 million in drilling costs, and $3.5 million on the PEA study and feasibility study costs. Drilling expenses totalled $2.9 million at the Boussoura project for the current year.

Share-based payments

Share-based payments totalled $3.5 million for the year ended December 31, 2020 compared to $2.5 million in 2019. The increase is mainly due to an increase in the Company’s share price.

Other income (expenses)

Other income (expenses) totalled $11.1 million in 2020, respectively compared to $18.7 million in the comparative period. The decrease is mainly attributed to the favourable movement in foreign exchange gain of $2.6 million in 2020 compared to a foreign exchange loss of $2.0 million in 2019.

Current and deferred income tax expense

The current income tax expense for year ended December 31, 2020 has increased to 2019 due to higher mine operating profits. The higher effective tax rate is also driven by the significant increase in exploration expenditures in 2020 incurred in Burkina Faso and Côte d’Ivoire not being tax effected due to the Company’s status under the mining regulations.

Net income & EBITDA

The Company’s net income was $24.9 million in 2020 and compared to net income of $5.7 million in 2019. The Company’s EBITDA2 was $94.9 million for the year ended December 31, 2020 compared to $69.4 million in 2019.

Net income increased significantly compared to 2019 primarily as a result of higher average realized gold sales price, offset by its focus on growth with significant investments in exploration and evaluation at Séguéla and Boussoura and higher depreciation.

Income Attributable to Non-Controlling Interest

For the year ended December 31, 2020, the income attributable to the non-controlling (“NCI”) interest was $6.0 million. The Government of Burkina Faso holds a 10% carried interest in Roxgold SANU SA and as such is considered Roxgold’s NCI. The NCI attributable income is based on IFRS accounting principles and does not reflect dividend payable to the minority shareholder of the operating legal entity in Burkina Faso.

Financial Position

At December 31, 2020, the Company had $61.9 million in cash and cash equivalents, with $34.6 million of long-term debt. The restricted cash totalling $2.1 million relates to funds restricted for the purposes of future restoration costs of the Yaramoko Gold Mine. The Company’s current assets exceeds its current liabilities by $32.1 million.

With the existing cash balance and the forecasted cash flows from operations, the Company is well positioned to fund its cash requirements for the next twelve months which relate primarily to the following activities:

- Underground development at the 55 Zone and Bagassi South

- Exploration programs at Séguéla and Boussoura

- Principal debt and interest repayments

- The potential commencement of construction at Séguéla pending the outcome of the feasibility study

The Company manages its capital structure and adjusts when necessary in accordance with its objectives and changes in economic conditions. During Q2 2020, the Company completed the refinancing of its existing credit facility by consolidating the outstanding principal amount of the original credit facility as well as the revolving credit facility into a single credit facility with an outstanding principal balance of $35.6 million as at December 31, 2020.

The Company’s total assets as at December 31, 2020 has increased by $51.9 million when compared to December 31, 2019. This is mainly driven by the increase in cash, and continuing investment in property, plant and equipment and increase in working capital.

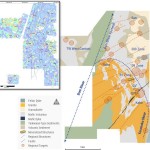

Yaramoko Mine Complex

The Yaramoko Mine Complex is situated in the Houndé greenstone belt region in the Province of Balé in southwestern Burkina Faso. The property is located approximately 200 kilometres southwest from the capital city of Ouagadougou. The Yaramoko Mine Complex consists of two high-grade underground gold mines: the 55 Zone and Bagassi South.

Mine Operating Activities

|

| Three months | Three months | Year ended | Year ended |

|

|

|

|

|

|

| Operating Data |

|

|

|

|

| Ore mined (tonnes) | 149,347 | 140,583 | 506,109 | 479,929 |

| Ore processed (tonnes) | 128,060 | 131,439 | 512,276 | 466,157 |

| Head grade (g/t) | 9.3 | 9.8 | 8.5 | 9.5 |

| Recovery (%) | 98.2 | 98.3 | 98.0 | 98.2 |

| Gold ounces produced | 35,191 | 41,162 | 133,940 | 142,204 |

| Gold ounces sold2 | 38,504 | 40,700 | 135,310 | 140,800 |

|

|

|

|

|

|

| Financial Data (in thousands of dollars) |

|

|

|

|

| Gold sales1 | 72,155 | 60,208 | 239,686 | 196,151 |

| Mine operating expenses2 | (23,231) | (19,130) | (81,890) | (69,371) |

| Government royalties2 | (4,340) | (4,296) | (14,392) | (10,680) |

| Depreciation and depletion2 | (16,628) | (16,359) | (55,023) | (51,823) |

|

|

|

|

|

|

| Statistics (in dollars) |

|

|

|

|

| Average realized selling price (per ounce) | 1,874 | 1,479 | 1,771 | 1,393 |

| Cash operating cost (per tonne processed)2 | 152 | 146 | 152 | 149 |

| Cash operating cost (per ounce produced)2 | 553 | 466 | 579 | 489 |

| Total cash cost (per ounce sold)2 | 682 | 576 | 692 | 568 |

| Sustaining capital cost (per ounce sold)2 | 180 | 269 | 262 | 216 |

| Site all-in sustaining cost (per ounce sold)2 | 862 | 845 | 954 | 784 |

Health and safety performance

Safety is a core value of Roxgold. There was one Lost Time Injury (“LTI”) incident in 2020. The LTI was suffered by a contractor’s employee and marked the first LTI incident at the Yaramoko Gold Mine since September 2018.

Contacts

Roxgold Inc.

Graeme Jennings, CFA

Vice President, Investor Relations

416-203-6401

[email protected]