Quick hits: Louisiana news briefs for Friday, March 26

Federal estimate: Louisiana GDP fell 5.5% in 2020

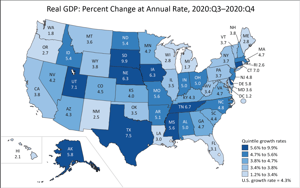

Louisiana’s gross domestic product declined 5.5% in 2020, which was greater than the national decline of 3.5% and more than any neighboring state, according to estimates the U.S. Bureau of Economic Analysis released Friday.

GDP declined in every state and in the District of Columbia last year, reflecting the impact of the COVID-19 pandemic. During the last three months of the year, Louisiana’s GDP increased by an annual rate of 3%, compared with a national 4th-quarter growth rate of 4.3%, according to BEA estimates.

GDP refers to the total value of all goods and services produced in a state or nation. The annual rate for quarterly numbers reflects how much GDP would change if the rate for a given quarter was the same for an entire year.

Workforce commission: State unemployment claims fell last week

New unemployment insurance claims for the week ending March 20 dropped to 6,468 from the previous week’s total of 7,195, the Louisiana Workforce Commission reported Friday.

Last year, during the week ending March 21, 2020, 72,438 initial claims were filed, reflecting the beginning of the COVID-19-related economic slowdown.

Continued state unemployment insurance claims for the week ending March 20 decreased to 40,840 from the week ending March 13 total of 46,170. The continued claims were above the comparable figure of 14,143 for the week ending March 21, 2020.

Revenue department reminder: Portion of unemployment benefits exempt from state income tax

The first $10,200 of unemployment benefits paid to Louisiana residents who received them in 2020 are exempt from Louisiana state income tax.

The federal American Rescue Plan, signed into law March 11, excludes from gross income the first $10,200 of unemployment benefits received in 2020 by taxpayers with incomes less than $150,000. The tax break includes state unemployment insurance programs and any increased benefits from the CARES Act and other federal legislation.

The Louisiana Department of Revenue said Louisiana taxpayers who have not filed their 2020 state income taxes should follow the instructions on their tax return. Those who have filed their state taxes already will need to file an amended state return to reduce their Louisiana adjusted gross income by the appropriate amount. Those forms are available at www.revenue.louisiana.gov/forms.

Disclaimer: This content is distributed by The Center Square