Policy paper: Louisiana tax system reinforces racial disparities

(The Center Square) – Poor Louisiana households pay a bigger share of their income in state and local taxes than richer households, which helps to reinforce longstanding racial disparities, an advocacy group argues in a new policy paper.

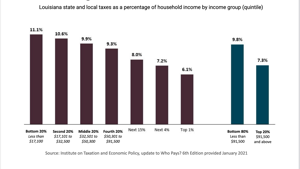

Thanks largely to high sales tax rates, the bottom 20% of Louisiana households in terms of income spends 11.1% of their income on state and local taxes, according to the Louisiana Budget Project, citing data from the Institute on Taxation and Economic Policy. The percentage falls as the income level rises; the top 1% pays 6.1%.

Broken down another way, the bottom 80% – those making less than $91,500 – pays 9.8% of its income on state and local taxes, while the top 20% pays 7.3%.

Since racial minorities are overrepresented in lower income rungs, they are most disadvantaged by the current system, the Louisiana Budget Project argues. For example, white households on average spend 8.2% of their income on state and local taxes, while Black households spend 8.8%.

“These higher tax rates on lower-income households impact communities of color more than white communities,” the group said. “Through our upside-down tax structure, Louisiana makes it more difficult for people and communities of color to build income and wealth over time.”

The Louisiana Budget Project closed the paper with several policy recommendations:

• Create a child tax credit for households earning less than $100,000 per year to help families, especially those with young children. An investment of $165 million would reach nearly 900,000 Louisiana children, the group said;

• Permanently expand the Earned Income Tax Credit from 5% to 10% to help low-income workers with and without children keep more of what they earn;

• End the deductibility of federal income taxes on state returns. Louisiana is one of only three states that allows this tax break, which primarily benefits high-income households and costs the state between $700 million and $900 million per year;

• Permanently eliminate the temporary 45-cent sales tax, which lawmakers implemented in 2018 as part of a budget deal and is scheduled to expire in 2025;

• Tax the wealthiest families by reinstating the inheritance tax (as 16 states and the District of Columbia have done), raising rates on capital gains income and establishing a “millionaire’s tax;”

• End the excess itemized deduction that primarily benefits high-income households in Louisiana and costs the state about $200 million a year.

Disclaimer: This content is distributed by The Center Square