Approval of the Amendment to Rallye’s Safeguard Plan Relating to the Global Tender Offer Launched by Rallye on Its Unsecured Debt and Announcement of the Settlement Date

PARIS–(BUSINESS WIRE)–Regulatory News:

Rallye (Paris:RAL) announces that the Paris Commercial Court has approved today the amendment to its safeguard plan, allowing therefore the effective completion of the global tender offer on its unsecured debt launched on January 22, 2021 (the “Tender Offer”) and the setting up of the financing of the Tender Offer (see Rallye’s press release dated January 22, 2021).

Consequently, and subject to the availability of the proceeds of the new financing, the settlement of the Tender Offer will occur on May 18, 2021.

Rallye will acquire a total amount of unsecured debt of approximately € 195.4m for a total repurchase price of approximately € 39.1m reducing the total amount of its debt by approximately € 156.3m. The total amount of unsecured debt purchased under the Tender Offer is allocated between the various instruments according to the breakdown set out in the annex to the press release issued by Rallye on 11 February 2021.

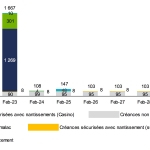

Following the settlement of the Tender Offer, the repayment profile of Rallye’s financial debt will be as follows:

[See multimedia attached]

The details of the unsecured notes purchased under the Tender Offer are broken down, in nominal value, according to the allocation set forth in the Appendix.

Distribution of this document in some jurisdictions may be restricted by law. Any persons in possession of this document are required to inform themselves of and to comply with all legal and regulatory restrictions.

Appendix

Unsecured notes in nominal value purchased under the Tender Offer

|

| Pre-Tender Offer | Amount Acquired | Post-Tender Offer |

| 2022 Notes (ISIN FR0012017903) | € 110,000,000 | € 27,500,000 | € 82,500,000 |

| 2020 EMTN Notes (ISIN CH0341440326) | CHF 75,000,000 | CHF 6,465,000 | CHF 68,535,000 |

| 2021 EMTN Notes (ISIN FR0011801596) | € 464,600,000 | € 26,000,000 | € 438,600,000 |

| 2023 EMTN Notes (ISIN FR0013257557) | € 350,000,000 | € 22,000,000 | € 328,000,000 |

| 2024 EMTN Notes (ISIN CH0398013778) | CHF 95,000,000 | CHF 15,025,000 | CHF 79,975,000 |

| Non-Dilutive Notes 2022 (ISIN FR0013215415) | € 200,000,000 | € 45,800,000 | € 154,200,000 |

| Exchangeable Notes (ISIN FR0011567908) | € 4,628,847.61 | € 1,680,920.69 | € 2,947,926.92 |

Contacts

Press contact:

Havas Paris

Aliénor Miens +33 6 64 32 81 75 [email protected]

Michaël Sadoun +33 6 82 34 76 26 [email protected]