D & P Advisory Curates ‘Beyond 22 Yards – IPL’s Legacy and WPL’s Vision’ – an IPL & WPL Valuation Report for the year 2024′

-

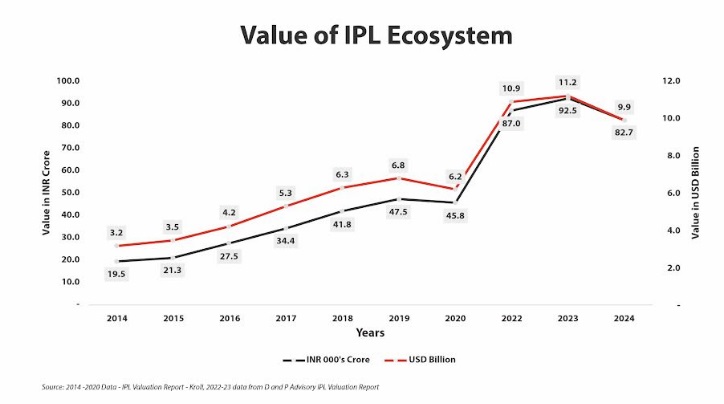

For the first time in the recent past, the IPL’s business enterprise value dropped to US$9.9 billion from US$11.2 billion last year. This marks a decrease of approximately 11.7%.

-

The decline in value results from a reassessment of media rights. D & P Advisorys prior report had factored in certain assumptions on the media rights valuation when it gets renewed (post the current cycle), but recent developments in the Media & Entertainment industry and expected reduced competitors / bidders in the next IPL auction have led to a downward revision of the estimates.

-

WPL’s business enterprise value increases to $160 million after the inaugural edition’s value of $150 million, marking an increase of almost 8%.

-

This year again, Mumbai Indians, emerged as the most valued IPL franchise in 2024, followed by Chennai Super Kings.

D & P Advisory, a provider of consulting, advisory, and valuation services, today released Beyond 22 Yards 2024 – IPL’s Legacy and WPL’s Vision, an IPL & WPL Valuation Report. In its second season, WPL witnessed impressive turnout drawing significant attention and support from fans. In parallel, the IPL 2024 witnessed unprecedented run scoring, with almost all high score records shattered this season. Remarkably, this IPL saw history being made with over 500 runs being scored in a single match.

You may download the report from the link provided here.

According to the report, compared to the last edition, the IPL ecosystem value has fallen from INR 92,500 Cr to 82,700 Cr, marking a decrease of around 10.6%. In USD terms, this translates to a decline from $11.2 billion to $9.9 billion, representing a decrease of approximately 11.7%. This downturn comes despite the leagues unyielding allure, which continues to attract audiences across television and digital platforms.

|

Value of IPL Ecosystem

In their previous year’s valuation report, they have already factored in the expected surge from the media rights renewal (post the current cycle). For the first time in 2022, the Board of Control for Cricket in India (BCCI) made the decision to bifurcate the media rights for TV and digital platforms for upcoming cycle of five years from 2023 season.

Santosh N, Managing Partner of D & P Advisory said, “We anticipate certain demand-side constraints in the next IPL media rights cycle auction due to a decrease in number of potential bidders. Several significant developments from the past year have led us to revise our media rights value estimates.”

The developments are –

-

The failed merger between Zee and Sony (which was expected to go through as of the last valuation) has impacted market dynamics.

-

The merging of Reliance-owned Network18 and Disney-owned Star India has essentially created monopolistic control over television and digital broadcasting.

-

The delay in the entry of major tech players such as Amazon, Meta, and Apple into the IPL media rights arena exacerbates the situation.

Looking forward, the potential dearth of vigorous competition could lead to a more conservative approach in the bidding for IPL media rights. According to Santosh N, “The days of escalating bid prices driven by fierce competition may be behind us, casting a shadow over the future growth trajectory of IPL’s media rights valuation. Despite a substantial growth opportunity for digital platforms, the pivotal question remains: will market forces generate sufficient competition to drive up the per-match value of IPL rights“

Compared to the previous edition, the WPL ecosystems value has increased from INR 1,250 Cr to 1,350 Cr, marking an 8.0% rise. In USD terms, this translates from $150 million to $160 million. The league has consistently been a thrilling blend of cricket, business, and entertainment, and this year was no different. It continued to captivate audiences across both television and digital platforms.

The report goes on to emphasize that a leagues media rights are its most valuable asset, underscored by the massive investments from broadcasters, tech giants, and OTT platforms seeking to capture their content. This defines the true value of their content and service offerings. In the last couple of years, the shift in the consumer content consumption, is disrupting the market in a big way.

India has witnessed a significant rise in internet penetration, driven largely by accessible data plans. The significant drop in the average cost of 1 GB of mobile data has democratized internet access across rural and urban areas, fostering digital inclusivity and fundamentally changing content consumption patterns. Also, the free streaming of IPL and other cricket content indicates a trend where cricket broadcasters may struggle to revert to a monetization model to retain consumer loyalty on their platforms.

The future of media rights for major sporting events like the IPL is increasingly shifting towards digital platforms rather than traditional television broadcasting as they cater to the modern viewers preferences for on-demand and personalized content consumption.

Some industry experts advocate for the BCCI to adopt a strategy similar to that of American sports leagues by segmenting and packaging IPL media rights. This method has become a global benchmark for enhancing the value of sports media rights, setting a precedent that can significantly benefit the IPL.

If tech giants like Amazon, Google, Apple, and Meta enter into the IPL broadcasting arena, it could further revolutionize sports media in India, as they leverage their digital infrastructure to enhance viewing experience and innovate on content delivery.

By shifting to digital platforms, the IPL and WPL have become accessible to fans in smaller towns and rural areas who were previously limited by cable or satellite access. This move is a significant step towards democratizing access to the league. As we continue this exciting journey, let us recognize that cricket in India transcends mere statistics; it embodies passion, dreams, and aspirations.

![]() Disclaimer: This content is distributed by Newsvoir.

Disclaimer: This content is distributed by Newsvoir.