Decentro Deepens Global SaaS Offering with Ledgers for Automated Reconciliation

-

Built in India, for the world, the Ledgers Module is currently enabling a time saving of at least 6-8 hours per week per company in terms of data reconciliation issues.

-

The company sees a $3.1 Billion market expansion opportunity here in terms of the global TAM that is in play around data quality & automation.

Decentro, India’s leading fintech infrastructure platform, has announced the global expansion of its comprehensive suite of the Ledgers module. Already empowering companies across India & Singapore, the company is looking to expand further across the world, with a focus on India, SEA, and MENA to name a few, in the next couple of quarters. Decentro’s Ledgers module empowers businesses of all sizes, in any country, to streamline and automate their data recording & reconciliation processes. Built in India, for the world, this module is already capable of handling 1000+ entries per second of any kind, and of any possible transaction type or currency.

|

Rohit Taneja, Founder & CEO, Decentro

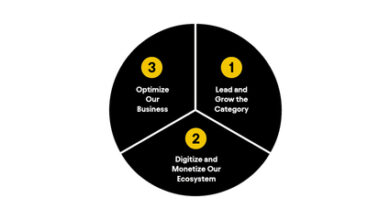

Decentro’s mission is to simplify the complexities of any kind of money flow by providing a robust infrastructure that is fully cloud native & automated from day 1. The company’s Ledgers module stands at the forefront of this mission, offering businesses a single, scalable system of record for all transactions and balances of any nature. By providing such comprehensive & scalable solutions, Decentro is reinforcing its commitment to “Building in India, for the world.”

Ledgers is an all-encompassing solution for tracking and reconciling data records in terms of consumer or business journeys. Businesses can ensure that every financial transaction of any nature is accurately recorded and easily accessible with the double-entry accounting system.

The product is designed to support a variety of use cases, such as:

-

Consumer apps & platforms that wish to track consumer loyalty & reward points globally

-

Financial institutions or fintechs looking to build a mini-LMS (Loan Management System) in-house on the cloud.

-

Companies looking to build an in-house or external treasury solution across geographies & currencies.

-

B2C chains with multiple outlets looking to track payables or wallet balances across their stores in multiple cities. & many more.

Commenting on this milestone, Rohit Taneja, Co-founder & CEO, Decentro said, “We are excited to publicly announce Ledgers as a solution that transcends borders and industries, providing a unified platform for data recording and management. Whether companies are managing loyalty programs, loan systems, or cross-border treasury operations, Ledgers offer the flexibility and reliability needed to support their growth without them getting distracted from their core products. Businesses can use the platform for dynamic calculations, setting up multiple journals to manage different transaction types, and end-to-end reconciliation for their funds. Since implementing Ledgers, our early customers in Singapore have reported a 7% improvement in their monthly operational costs and a reduction in the time spent in their reconciliation/accounting departments by more than 10%. This comprehensive approach ensures that all financial activities are accurately tracked and reported, reducing the risk of human errors and improving overall financial transparency.”

Omni-channel retail & D2C brands like Owndays (part of Lenskart now) went live with the Ledgers module in January this year, to manage their loyalty points across multiple geographies, thus leading to an amazing customer experience with 300+ data entries per day. MFIs are also looking to integrate and leverage Ledgers to track all their loans, and repayments via various payment modes across Africa. Ledgers offer several key benefits to businesses, enhancing financial operations and efficiency:

-

Single source of truth: Provides a single and scalable system of record for all transactions and balances.

-

Easy integration: REST APIs can be used on mobile apps or web applications, ensuring seamless integration with existing systems resulting in more than 10% reduction in operational overheads.

-

Multi-currency support: Supports multiple ledgers across any currency or merchant, catering to diverse business needs when it comes to recording money movement.

-

Comprehensive reconciliation: Ready-to-consume reconciliation APIs ensure that all financial activities are accurately tracked and reported.

Decentro expanded into Southeast Asia in March 2023 by launching its payments module in Singapore. With Asia-Pacific being a hotbed for digital banking solutions, Decentro aims to double its regional business growth by the end of 2024 to process 5M+ transactions on a recurring basis outside India.

About Decentro

Founded in mid-2020, Decentro is a full-stack fintech infrastructure platform built from India. With their products – Flow (Payment Collections & Settlements) and Fabric (Banking as a Service), they now have around 10 powerful modules across identity and payments.

Decentro powers more than 900 companies, including CashE, Shiprocket, MoneyTap, AU small finance bank, and many more, in terms of plug & play SaaS. Decentro was founded by Rohit Taneja and Pratik Daudkhane and is backed by investors like Y-Combinator, Rapyd Ventures, and Uncorrelated Ventures, among many others.

For more information please visit: decentro.tech.

![]() Disclaimer: This content is distributed by Newsvoir.

Disclaimer: This content is distributed by Newsvoir.