Global Venture Capital Annual Investment Shatters Records Following Another Healthy Quarter, Says KPMG Private Enterprise’s Venture Pulse Report

Annual venture capital investment reaches US$671 billion invested across 38,644 deals

Global VC-backed exits achieve record year of US$1.38 trillion, propelled by IPO market

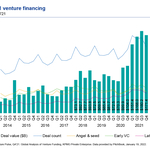

NEW YORK–(BUSINESS WIRE)–Venture capital investment remained close to record levels with the swift pace of Q4’21, capping off what has been a banner year for the global venture capital market. According to the Q4’21 edition of Venture Pulse – a quarterly report published by KPMG Private Enterprise on VC trends in key jurisdictions around the world, the quarter witnessed near-record highs for total venture capital investment, corporate venture capital investment, exits and global fundraising.

Global quarterly venture capital investment surpassed the US$150 billion mark in consecutive quarters this year, reaching $171 billion across 8,710 deals during Q4’21 – only slightly below the previous high of $180 billion on 9,953 deals achieved in Q3’21.

Nine $1 billion+ megadeals by companies in the US and Asia helped drive the surge – contributing over $13.5 billion to the quarterly global investment total – including funding rounds of $2.5 billion raise by Jakarta-based J&T Express, $1.8 billion by US-based Commonwealth Fusion Systems and $1.5 billion by US-based Gopuff and China-based Regor Therapeutics respectively.

Global VC investment rose from $347 billion across 31,623 deals in 2020 to a record $671 billion across 38,644 deals in 2021 – with a dramatic increase in valuations and deal sizes across all jurisdictions and stages of investment.

The Americas led VC investment in Q4’21, with $95.2 billion contributing to the Americas overall $361 billion record total VC investment in 2021, with the US accounting for $330 billion, including $88 billion in the final quarter of the year: a new quarterly high. VC investment in Europe also rose from $54 billion across 8,968 deals in 2020 to $123 billion across 9,710 deals in 2021. The Asia-Pacific region saw $181 billion in VC investment across 10,498 deals in 2021 – compared to $116 billion on 8,385 deals in 2020.

“2021 was a remarkable year for the global venture capital market,” said Conor Moore, Head of KPMG Private Enterprise in the Americas region, and Partner at KPMG in the US. “The wealth of dry powder, combined with the continued involvement of non-traditional investors and powerful surge in exit activity have combined to propel venture capital investment in companies across all sectors to new heights, albeit the larger organizations able to chart better performance, raised the bigger funds.”

VC investment is expected to remain robust in Q1’22 throughout most regions, with less developed VC markets, such as Africa and the Middle East, expected to attract more attention from VC investors. Fintech will likely remain one of the hottest areas of investment, in addition to B2B services, healthtech, cybersecurity, and AI solutions across sectors.

“2021 was a ground-breaking year for VC investment around the world – characterized by high valuations and increasingly large deals, as investors continued to pour money into late-stage rounds,” said Moore. “As we look forward to 2022, we expect exit activity – both in terms of IPOs and mergers and acquisitions – will remain vibrant and continue to spur healthy valuations and deliver yet another year of strong investment in the venture ecosystem.”

Q4’21 Highlights

- Global VC investment dropped very slightly from a record $180 billion across 9,953 deals in Q3’21 to $171 billion across 8,710 deals in Q4’21. The US alone accounted for $88.2 billion of that investment, a new quarterly record.

- On a regional level, the Americas led VC investment in Q4’21, with $95.2 billion, followed by Asia ($46.2 billion) and Europe ($28 billion).

- Corporate VC remained strong, reaching $81 billion in Q4’21, slightly off the previous record of $90 billion set in Q3’21.

- The percentage of investment by corporates reached an all new high in Q4’21, with corporates participating in 29.4% of all VC deals globally.

Key 2021 Annual Highlights

- Global VC investment rose from $347 billion across 31,623 deals in 2020 to a record $671 billion across 38,644 deals in 2021. It was a record year for VC investment in all regions of the world.

- VC investment in the Americas more than doubled from $175 billion across 13,600 deals in 2020 to $361 billion across 17,449 deals in 2021.

- European VC also doubled from $54 billion across 8,968 deals in 2020 to $123 billion across 9,710 deals in 2021.

- The Asia-Pacific region saw $181 billion in VC investment across 10,498 deals in 2021 –compared to $116 billion on 8,385 deals in 2020.

- Global median pre-money valuations for D+ rounds more than doubled year over year, reaching $1 billion.

- Global corporate VC remained hot to close out the year, with $81 billion invested in Q4’21 – making it the second highest quarter ever and capping of a record annual total of $315 billion.

- First-time financings resurged in both count and aggregate VC invested, hitting $54.3 billion in 2021, up from $31.1 billion in 2020.

- VC-backed exit value had another strong quarter and on an annual basis rose from $473 billion in 2020 to $1.378 billion in 2021. Total annual exit value passed the $1 trillion for the first time ever. The US led the way with $774 billion.

About KPMG Private Enterprise

You know KPMG, you might not know KPMG Private Enterprise. KPMG Private Enterprise advisers in KPMG firms around the world are dedicated to working with you and your business, no matter where you are in your growth journey —whether you’re looking to reach new heights, embrace technology, plan for an exit, or manage the transition of wealth or your business to the next generation. You gain access to KPMG’s global resources through a single point of contact —a trusted adviser to your company. It is a local touch with a global reach.

The KPMG Private Enterprise Global Network for Emerging Giants has extensive knowledge and experience working with the start-up ecosystem. Whether you are looking to establish your operations, raise capital, expand abroad, or simply comply with regulatory requirements —we can help. From seed to speed, we’re here throughout your journey.

About KPMG International Limited

KPMG is a global organization of independent professional services firms providing Audit, Tax and Advisory services. KPMG is the brand under which the member firms of KPMG International Limited (“KPMG International”) operate and provide professional services. “KPMG” is used to refer to individual member firms within the KPMG organization or to one or more member firms collectively.

KPMG firms operate in 145 countries and territories with more than 236,000 partners and employees working in member firms around the world. Each KPMG firm is a legally distinct and separate entity and describes itself as such. Each KPMG member firm is responsible for its own obligations and liabilities.

KPMG International Limited is a private English company limited by guarantee. KPMG International Limited and its related entities do not provide services to clients.

For more detail about our structure, please visit home.kpmg/governance.

Contacts

For more information:

Daniel Caines

+447732400262

https://home.kpmg/xx/en/home/contacts/c/daniel-caines.html