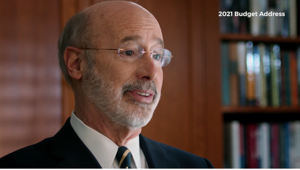

Multi-billion-dollar tax increase still a priority for Pennsylvania governor

(The Center Square) – Gov. Tom Wolf still supports raising personal income taxes this year and sees the $7.3 billion in federal pandemic aid doled out in March as less useful in fixing the state’s $2 billion structural deficit.

“It’s important to fill the holes and address the needs in the short term, but that doesn’t take away from the structural deficit,” said Budget Secretary Jen Swails during an late April hearing of the Senate Appropriations Committee. “While I know a conversation on increased revenue is difficult, addressing the structural deficit needs to occur at some point in time and I know with that $7.3 [billion] coming in, that makes it a lot harder to discuss.”

In February, Wolf proposed raising the personal income tax from 3.07% to 4.49% on the top third of earners in the state. The plan also expands poverty thresholds for tax forgiveness, untouched since 2004, and reforms the existing structure so that some middle incomes families pay the same rate. The Department of Revenue projects that families a four making over $84,000 will see the PIT increase.

The administration said its proposal expands forgiveness for 2.2 million filers and should generate $3 billion in revenue – a sum Wolf wanted lawmakers to spend on public education and backfilling the budget deficit.

He said the state’s 3.07% personal income tax – one of the lowest rates nationwide – forces most residents to pay a higher share of their income than those like him with more financial security.

The disparity means rural communities and cash-strapped cities alike raise property taxes year after year to fund schools and fix roads and bridges. And businesses, he said, pay some of the highest tax rates in the country – another side effect he says makes little sense.

Appropriations Committee Majority Chairman Pat Browne, R-Allentown, agrees that lawmakers should discuss appropriate poverty thresholds for tax forgiveness since the policy has been unadjusted since 2004, but worries the governor’s proposal “takes that conversation beyond the original expectation of that program.”

“It expands it to incomes that would normally not be considered under the general terms of poverty,” he said. “I think, at a minimum, you could support an inflationary adjustment from 2004, and we could easily sustain it.”

He also worried that the state may run out of time to spend the $7.3 billion its been allocated from the American Rescue Plan if some of the money isn’t used for budget gaps. Congress gave states a 2024 deadline to use or lose the federal aid.

“My concern would be that without an adjustment on that revenue proposal, we would have a significant amount of dollars we would not be able to appropriate because of the size,” he said.

House Majority Leader Kerry Benninghoff, R-Bellefonte, said during a news conference last week that his caucus’s goal is to pass a “prudent” and “balanced” budget by the June 30 deadline.

“I don’t think we want to be shortsighted and think we can go on a spending spree,” he said. “We have deficits to take care of it and this relief money can help address those.”

Disclaimer: This content is distributed by The Center Square