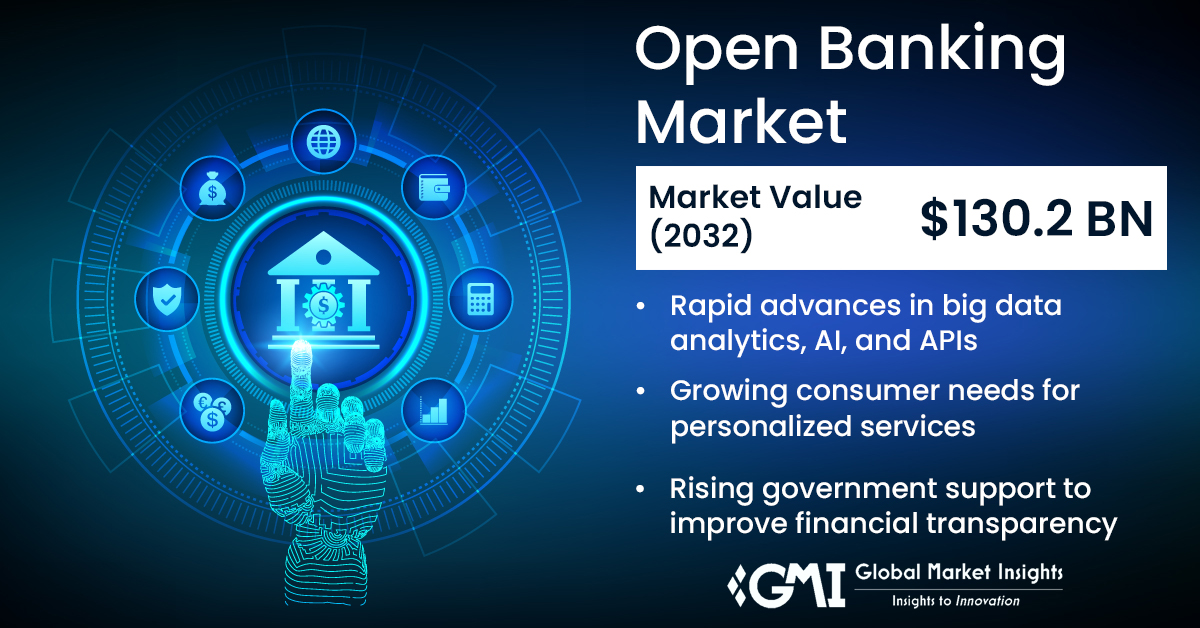

Open Banking Market to cross $130.2 Bn by 2032, Says Global Market Insights Inc.

Major open banking market participants include Accenture, Tink, Finicity (Mastercard), Capgemini, F5, Inc., Virtusa Corp., MuleSoft (Salesforce), Yodlee (Envestnet), Plaid, TrueLayer, and Token.io.

Selbyville, Delaware, Aug. 26, 2024 (GLOBE NEWSWIRE) —

The open banking market valuation is predicted to cross USD 130.2 billion by 2032, as reported in a

Some of the prominent open banking market companies include Accenture, Tink, Finicity (Mastercard), Capgemini, F5, Inc., Virtusa Corp., MuleSoft (Salesforce), Yodlee (Envestnet), Plaid, TrueLayer, and Token.io. These industry players are placing efforts on partnership-based strategies to match the rising consumer and end-user needs to widen their global presence. To quote an instance, in February 2024, financial technology leader FIS inked a strategic collaboration with Banked, a well-known open banking solutions provider, to drive new pay-by-bank offerings for businesses and consumers.

Partial chapters of report table of contents (TOC):

Chapter 1 Methodology & Scope

1.1 Market scope & definition

1.2 Research design

1.2.1 Research approach

1.2.2 Data collection methods

1.3 Base estimates & calculations

1.3.1 Base year calculation

1.3.2 Key trends for market estimation

1.4 Forecast model

1.5 Primary research and validation

1.5.1 Primary sources

1.5.2 Data mining sources

Chapter 2 Executive Summary

2.1 Open Banking Market 3600 synopsis, 2021 – 2032

Chapter 3 Open Banking Market Insights

3.1 Industry ecosystem analysis

3.2 Supplier landscape

3.2.1 API platforms and gateway providers

3.2.2 Security solutions providers

3.2.3 RegTech providers

3.2.4 End user

3.3 Profit margin analysis

3.4 Technology & innovation landscape

3.5 Patent analysis

3.6 Key news & initiatives

3.7 Regulatory landscape

3.8 Impact forces

3.8.1 Growth drivers

3.8.1.1 Increase in adoption of digital banking for convenience and accessibility

3.8.1.2 Technological advancements in big data analytics, artificial intelligence (AI), and APIs

3.8.1.3 Government initiatives and regulatory support to enhance financial transparency

3.8.1.4 Consumer demand for personalized services

3.8.2 Industry pitfalls & challenges

3.8.2.1 Security and privacy concerns

3.8.2.2 Lack of consumer trust and adoption

3.9 Growth potential analysis

3.10 Porter’s analysis

3.11 PESTEL analysis

Browse Related Reports:

Cryptocurrency Payment Apps Market Size – By Platform (Mobile Apps, Web-Based Platforms), By Cryptocurrency (Bitcoin, Ethereum, Litecoin, Ripple), By Functionality, By Application, By End User & Forecast, 2024 – 2032

https://www.gminsights.com/industry-analysis/cryptocurrency-payment-apps-market

Payment Processing Solutions Market Size – By Technology (NFC, QR Code, EMV), By Deployment (In-Store, Online, Mobile), By Mode of Payment (Credit Cards, Debit Cards, E-Wallets), By Organization Size, By End User & Forecast, 2024 – 2032

https://www.gminsights.com/industry-analysis/payment-processing-solutions-market

About Global Market Insights Inc.

Global Market Insights Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider, offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy, and biotechnology.

CONTACT: Contact Us: Aashit Tiwari Corporate Sales, USA Global Market Insights Inc. Toll Free: 1-888-689-0688 USA: +1-302-846-7766 Europe: +44-742-759-8484 APAC: +65-3129-7718 Email: [email protected]