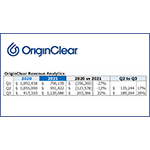

OriginClear Continues Revenue and Gross Profit Growth in Q3

Revenue up 20% and Gross Profits up 87% over Q2, while operating losses narrowed.

CLEARWATER, Fla.–(BUSINESS WIRE)–$OCLN #water—OriginClear Inc. (OTC Pink: OCLN), a leading corporation in the self-reliant water revolution that develops outsourced pay-per-gallon programs, announced today that revenues and gross profits for the Third Quarter of 2021 improved significantly over the Second Quarter, while operating losses narrowed.

The company reported the following highlights from its recent quarterly report:

– Third Quarter 2021 over Second Quarter 2021:

- Revenue improved by 20% to $1,120,687 compared to $931,422.

- Gross Profit improved by 87% to $330,351 compared to $176,500.

- Cost of Sales grew by 5% to $790,336 compared to $754,922.

- Operating Losses narrowed to $(1,323,074) compared to $(1,929,679).

– Third Quarter 2021 over Third Quarter 2020:

- Revenue improved by 22% to $1,120,687 compared to $917,320.

- Gross Profit improved to $330,351 compared to $(17,388).

- Cost of Sales improved by 15% to $790,336 compared to $934,708.

- Operating Losses grew to $(1,323,074) compared to $(1,183,722).

“We are very pleased with the progress of our Progressive Water Treatment and Modular Water Treatment divisions,” said Riggs Eckelberry, OriginClear CEO.

“The growth of our conventional business is wonderful news,” said Tom Marchesello, OriginClear COO. “And now with the launch of our Water On Demand pre-funded water equipment program, we believe that the year ahead is promising.”

| ORIGINCLEAR, INC. AND SUBSIDIARIES | ||||||||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | ||||||||||||||||

| FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 AND 2020 | ||||||||||||||||

| (Unaudited) | ||||||||||||||||

|

| Three Months Ended | Nine Months Ended | ||||||||||||||

|

| September 30, | September 30, | September 30, | September 30, | ||||||||||||

|

|

|

|

|

| ||||||||||||

| Sales | $ | 1,120,687 |

| $ | 917,320 |

| $ | 2,848,287 |

| $ | 3,064,758 |

| ||||

|

|

|

|

|

| ||||||||||||

| Cost of Goods Sold |

| 790,336 |

|

| 934,708 |

|

| 2,237,282 |

|

| 2,716,582 |

| ||||

|

|

|

|

|

| ||||||||||||

| Gross Profit |

| 330,351 |

|

| (17,388 | ) |

| 611,005 |

|

| 348,176 |

| ||||

|

|

|

|

|

| ||||||||||||

| Operating Expenses |

|

|

|

| ||||||||||||

| Selling and marketing expenses |

| 636,481 |

|

| 339,759 |

|

| 2,201,045 |

|

| 1,053,559 |

| ||||

| General and administrative expenses |

| 1,006,041 |

|

| 782,810 |

|

| 2,785,713 |

|

| 1,853,760 |

| ||||

| Research and development |

| – |

|

| 29,334 |

|

| – |

|

| 83,400 |

| ||||

| Depreciation and amortization expense |

| 10,903 |

|

| 14,431 |

|

| 34,034 |

|

| 39,892 |

| ||||

|

|

|

|

|

| ||||||||||||

| Total Operating Expenses |

| 1,653,425 |

|

| 1,166,334 |

|

| 5,020,792 |

|

| 3,030,611 |

| ||||

|

|

|

|

|

| ||||||||||||

| Loss from Operations |

| (1,323,074 | ) |

| (1,183,722 | ) |

| (4,409,787 | ) |

| (2,682,435 | ) | ||||

|

|

|

|

|

| ||||||||||||

| OTHER INCOME (EXPENSE) |

|

|

|

| ||||||||||||

| Other income |

| 356,438 |

|

| 4,001 |

|

| 359,939 |

|

| 12,521 |

| ||||

| Impairment of asset for sale |

| (116,000 | ) |

| – |

|

| (116,000 | ) |

| – |

| ||||

| Gain on write off loans payable |

| 151,000 |

|

| – |

|

| 157,250 |

|

| – |

| ||||

| Gain/(Loss) on conversion of preferred stock |

| (146,382 | ) |

| 18,066 |

|

| (1,265,666 | ) |

| 24,129 |

| ||||

| Loss on exchange of preferred stock |

| – |

|

| – |

|

| (40,000 | ) |

| – |

| ||||

| Unrealized gain(loss) on investment securities |

| (8,400 | ) |

| 3,600 |

|

| 32,000 |

|

| 400 |

| ||||

| Gain on net change in derivative liability and conversion of debt |

| 19,798,080 |

|

| 6,409,231 |

|

| (4,146,757 | ) |

| 23,627,793 |

| ||||

| Interest expense |

| (314,547 | ) |

| (233,010 | ) |

| (934,942 | ) |

| (638,077 | ) | ||||

|

|

|

|

|

| ||||||||||||

| TOTAL OTHER (EXPENSE) INCOME |

| 19,720,189 |

|

| 6,201,888 |

|

| (5,954,176 | ) |

| 23,026,766 |

| ||||

|

|

|

|

|

| ||||||||||||

| NET INCOME (LOSS) | $ | 18,397,115 |

| $ | 5,018,166 |

| $ | (10,363,963 | ) | $ | 20,344,331 |

| ||||

|

|

|

|

|

| ||||||||||||

| PREFERRED STOCK DIVIDENDS |

| – |

|

| – |

|

| – |

|

| – |

| ||||

| WARRANTS DEEMED DIVIDENDS |

| – |

|

| – |

|

| (2,037,849 | ) |

| – |

| ||||

|

|

|

|

|

| ||||||||||||

| NET (LOSS) ATTRIBUTABLE TO SHAREHOLDERS INCOME | $ | 18,397,115 |

| $ | 5,018,166 |

| $ | (12,401,812 | ) | $ | 20,344,331 |

| ||||

|

|

|

|

|

| ||||||||||||

| BASIC EARNINGS (LOSS) PER SHARE ATTRIBUTABLE TO SHAREHOLDERS’ | $ | 0.09 |

| $ | 0.27 |

| $ | (0.08 | ) | $ | 1.75 |

| ||||

|

|

|

|

|

| ||||||||||||

| DILUTED EARNINGS (LOSS) PER SHARE ATTRIBUTABLE TO SHAREHOLDERS’ | $ | 0.02 |

| $ | 0.03 |

| $ | (0.08 | ) | $ | 0.15 |

| ||||

|

|

|

|

|

| ||||||||||||

| WEIGHTED-AVERAGE COMMON SHARES OUTSTANDING, BASIC |

| 197,669,804 |

|

| 18,643,531 |

|

| 147,762,596 |

|

| 11,598,453 |

| ||||

|

|

|

|

|

| ||||||||||||

| DILUTED |

| 795,174,058 |

|

| 146,074,997 |

|

| 147,762,596 |

|

| 139,029,918 |

| ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

About OriginClear Inc.

OriginClear leads the self-reliant water revolution, democratizing water investment by developing a marketplace to connect investors with water projects; and commercializing modular, prefabricated, filter-free advanced systems for faster sanitation worldwide. With America’s broken infrastructure and 100 billion dollars of government spending to fix the nation’s 150,000-plus water systems, OriginClear is helping them “cut the cord”, by developing outsourced pay-per-gallon programs and a future digital currency to streamline payments. Our line of Modular Water products and systems is key to the self-reliant water treatment revolution as they create “instant infrastructure” – fully engineered, prefabricated and prepackaged systems that use durable, sophisticated materials. To learn more about OriginClear®, please visit our website at www.originclear.com.

For more information, visit the company’s website: www.OriginClear.com

Follow us on Twitter

Follow us on LinkedIn

Like us on Facebook

Subscribe to us on YouTube

Signup for our Newsletter

OriginClear Safe Harbor Statement:

Matters discussed in this release contain forward-looking statements. When used in this release, the words “anticipate,” “believe,” “estimate,” “may,” “intend,” “expect” and similar expressions identify such forward-looking statements. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained herein.

These forward-looking statements are based largely on the expectations of the Company and are subject to a number of risks and uncertainties. These include, but are not limited to, risks and uncertainties associated with our history of losses and our need to raise additional financing, the acceptance of our products and technology in the marketplace, our ability to demonstrate the commercial viability of our products and technology and our need to increase the size of our organization, and if or when the Company will receive and/or fulfill its obligations under any purchaser orders. Further information on the Company’s risk factors is contained in the Company’s quarterly and annual reports as filed with the Securities and Exchange Commission. The Company undertakes no obligation to revise or update publicly any forward-looking statements for any reason except as may be required under applicable laws.

Contacts

Media Contact

The Pontes Group

Lais Pontes Greene (954) 960-6083

[email protected]

www.thepontesgroup.com

Investor Relations and Press Contact:

Devin Angus

Toll-free: 877-999-OOIL (6645) Ext. 3

International: +1-323-939-6645 Ext. 3

Fax: 323-315-2301

[email protected]

www.OriginClear.com