Phoenix Holdings Reports Results for the Second Quarter and First Half of 2022

Continues to Consistently Execute Against Strategic Objectives

TEL AVIV, Israel–(BUSINESS WIRE)–Phoenix Holdings Ltd., a leading Israel-based financial, insurance, and investment group (TASE: PHOE) (“The Phoenix”, the “Group”, or the “Company”), today reported its results for the second quarter and first half of 2022.

Highlights

- The Group reports comprehensive income after tax of 184 million NIS for the second quarter of 2022 and 537 million NIS for the first half of 2022, reflecting a return on equity of 7.9% and 11.4% respectively, despite capital markets declines

- The Phoenix announces a dividend of 160 million NIS for first half of 2022 in accordance with the Group’s dividend policy

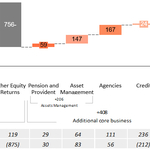

- Core non-insurance activities (asset management, agencies, and credit) contributed after-tax comprehensive income of 193 million NIS (excluding special items) in the first half of 2022

- Total premiums and contributions were 17.1 billion NIS in the first half of 2022, an increase of 36% compared to the previous year

- The Group published its inaugural ESG report in June 2022 and was upgraded to Platinum rating by “Maala”

The first half of 2022 was characterized by high volatility in financial markets in Israel and abroad, which was reflected mainly in declines in market yields and an increase in interest rates. The Group continues to actively manage its investments against the volatile market backdrop. Group assets under management as of June 30, 2022 were 361 billion NIS.

As of June 30, 2022, equity was 9.7 billion NIS, following the distribution of a dividend of 421 million NIS and the buyback of approximately 56 million NIS in shares during the first half of the year.

Eyal Ben Simon, CEO of the Phoenix Holdings:

“The Phoenix reports improved 6-month results in line with our strategic plan focused on generating a high return on equity, driving innovation and efficiency, actively managing all levels of the Group, and optimized capital deployment.

These results highlight the benefits of a strategy based on a range of financial activities, including insurance, asset management, distribution and credit, creating competitive advantage that allows us to accelerate growth in activities that generate high returns even in a volatile capital market.

The Phoenix, as the largest diversified financial group in Israel, operates with a clear focus on continued value creation. In accordance with our semi-annual dividend policy, the Phoenix is distributing 160 million NIS, in addition to the share buyback program.

Looking ahead to the rest of the year, the Company is working to accelerate growth with a focus on income, continued improvement of efficiency, and dynamic investment management in line with the market environment. As a result, I am encouraged by the investments we are making in the areas of organizational and technological infrastructure, innovation, and the development of digital products that are already receiving recognition and high satisfaction from our customers.

We are committed to continuing to improve performance and provide best-in-class financial solutions to our clients, as well as to meet the strategic goals we have set for the medium term, even in the face of changing macro conditions. The Phoenix is better prepared than ever to leverage its competitive and business advantage to drive continued growth and profitability and to capitalize on business opportunities.”

The following are highlights from the financial statements

Comprehensive Income to shareholders:

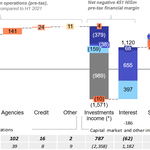

The total comprehensive income to shareholders in the second quarter of 2022 and the first half of 2022 amounts to 184 million NIS and 537 million NIS, respectively, with a return on equity to shareholders of 7.9% and 11.4%, respectively. This compares with a total of 797 million NIS and 1,153 million NIS in the corresponding periods in 2021. The decline in profit compared to the prior year relates mainly to the effects of the decline in the capital markets, which was offset by the effect of increases in interest rates on insurance liabilities, and special effects.

Shareholders’ Equity and solvency ratio:

The equity attributable to the Company’s shareholders amounted to approximately 9.7 billion NIS as of June 30, 2022.

Phoenix Insurance published a Solvency II ratio as of December 31, 2021 of 190% with transitional measures. The ratio includes events after the reporting period and until the publication date; including dividends from Phoenix Insurance to the Company, the issuance of a Tier 2 capital instrument and the transfer of a real estate asset (“Phoeniclass”) (49%) within the Phoenix group. The medium-term solvency target for Phoenix Insurance is in the range of 150-170%.

The minimum solvency threshold (without transitional measures) for future dividend distributions was updated from 108% to 111%.

The impact of the decline in the capital markets and the increase in interest rates:

The Group reports a negative pre-tax impact in the first half of 2022 of 451 million NIS resulting from the gap between the declines in the capital markets and the increase in interest rates. In July and August, there was a negative financial margin of 85 million NIS.

The effect of the increase in interest rates was a positive total of 1.12 billion NIS. The negative return on Nostro investments was (0.4%). Based on this return, an annual real return of 3% and variable management fees calculated using the same annual real return, were transferred (deducted), to the underwriting profit, resulting in a total negative impact of the capital markets of 451 million NIS.

Premiums and Contributions:

Premiums and contributions fees in the first half of 2022 totaled 17.1 billion NIS, compared to 12.6 billion NIS in the corresponding period last year.

Investment in innovation:

The Phoenix consistently invests in innovation and digitization as part of focusing on client needs and maintaining a high standard of service. The Group is investing approximately 1 billion NIS in advanced technology and data capabilities, which provide analytic and measurement tools to ensure operational efficiency and support ongoing improvement of performance.

Financial Strength:

The Company’s credit rating is AA-, while Phoenix Insurance’s credit rating is AA+. The Group has financial flexibility and a high liquidity profile.

The following are the main financial results of the Group’s activity segments:

(For more details regarding changes in financial results, see the Financial Statements and the investor presentation)

P&C

The total pre-tax loss in the second quarter of 2022 and in the first half of 2022 amounted to (92) million NIS and (234) million NIS, respectively, compared with a total pre-tax profit of 232 million NIS and 410 million NIS in the corresponding periods last year. The decline in profitability is mainly due to the decline in investment income and the increase in cost and an increase in the prevalence of claims in the property vehicle industry. In the automotive and property industry, the Phoenix consistently works to improve underwriting results and makes necessary adjustments, including the full implementation of an advanced data model. In the second quarter of 2022, the Phoenix recorded an underwriting profit of 73 million NIS in the general insurance sector.

Life Insurance & Savings

The total pre-tax profit in the second quarter of 2022 and in the first half of 2022 amounted to 314 million NIS and 478 million NIS, respectively, compared with total pre-tax profit of 386 million NIS and 662 million NIS in the corresponding periods last year. The results were primarily impacted by the decline in investment income and the non-collection of variable management fees, which were partly offset by the increase in the risk-free interest rate curve, which led to a decrease in insurance reserves, and by extraordinary items.

Extraordinary items in the second quarter of 2022 mainly include: (a) the effect from the completion of a study on retirement ages and benefit utilization rates, following which a profit of approximately 462 million NIS was recorded before tax; (b) a reapplication and implementation of a circular regarding the revision of mortality assumptions that caused a pre-tax loss of 364 million NIS.

As of June 30, 2022, the effect of the decline in the members’ assets portfolio will lead to the non-collection of variable management fees in the future in the amount of approximately 507 million NIS, before tax (as of the date of publication of the report, in the amount of approximately 421 million NIS, before tax).

Provident and Pension Funds

The total pre-tax profit in the second quarter of 2022 and in the first half of 2022 amounted to 38 million NIS and 59 million NIS, respectively, compared with total pre-tax profit of 15 million NIS and 29 million NIS in the corresponding periods last year. In the second quarter of 2022, a one-time profit of 14 million NIS was recorded as a result of the sale of the IRA portfolio, which was owned by Halman Aldubi.

Health Insurance

The total pre-tax profit in the second quarter of 2022 and in the first half of 2022 amounted to 188 million NIS and 843 million NIS, respectively, compared with a total pre-tax loss of (4) million NIS and a pre-tax profit of 19 million NIS in the corresponding periods last year. The increase in profit is mainly attributable to the increase in the risk-free interest rate, resulted in a decrease of reserves and extraordinary items (mainly due to the transfer of the company’s rights in a real estate asset (“Phoeniclass”) to Phoenix Insurance in the first quarter), offset by a decline in income from investments.

Investment Services (including Excellence)

The total pre-tax profit in the second quarter of 2022 and in the first half of 2022 amounted to 124 million NIS and 147 million NIS, respectively, compared with total pre-tax profit of 31 million NIS and 64 million NIS in the corresponding periods last year. The increase is mainly attributable to an increase in profit from operations and a one-time effect of 86 million NIS from the recording of profit as a result of the increase in control of Phoenix Capital.

Agencies

The total pre-tax profit in the second quarter of 2022 and in the first half of 2022 amounted to 95 million NIS and 167 million NIS, respectively, compared with total pre-tax profit of 59 million NIS and 111 million NIS in the corresponding period last year.

The increase in profit is attributable to an increase in profit from organic growth and the recording of a one-time profit of 22 million NIS as a result of an increase in control of an agency held by a subsidiary of the Company.

Credit (including Gama)

The total pre-tax profit in the second quarter of 2022 and in the first half of 2022 amounted to 12 million NIS and 25 million NIS, respectively, compared with total pre-tax profit of 235 million NIS and 236 million NIS in the corresponding periods last year. In the corresponding periods last year, a profit of about 220 million NIS was recorded resulting from a one-time capital gain as a result of an increase in control of Gama.

Other Equity Returns

The total pre-tax loss in the second quarter of 2022 and in the first half of 2022 amounted to 478 million NIS and 756 million NIS, respectively, compared with a total pre-tax profit of 155 million NIS and 119 million NIS in the corresponding period last year. The decline in profit is attributed mainly from the preparation of investments as a result of declines in the financial markets in Israel and abroad.

Conference Call Information

Phoenix Holdings will hold a conference call on Thursday, August 25, 2022 at 1pm local time in Hebrew and at 5pm local time / 3pm UK / 10am ET in English, and has published dial-in details and the presentation through the Tel Aviv Stock Exchange website.

About Phoenix Holdings

Phoenix Holdings is a leading Israel-based diversified financial, insurance, and investment group traded on the Tel Aviv Stock Exchange (TASE: PHOE). Group activities include multi-line insurance, investment and asset management, credit, and financial product distribution, and have demonstrated strong growth and performance across the cycle. The Phoenix serves a significant portion of Israeli households with a broad set of activities and solutions across businesses and client segments. Managing over $100 billion in assets, the Phoenix accesses Israel’s vibrant and innovative economic activity through a robust investment portfolio, creating value for both clients and shareholders.

Contacts

For further information:

David Alexander

Phoenix Holdings, Deputy CEO

Email: [email protected]

Tel: +972 (3) 733-2979

Robert Brinberg

Rose & Company

Email: [email protected]

Tel: +1 (212) 517-0810