UBS reports 2Q24 net profit of USD 1.1bn with continued client momentum and integration progress (Ad hoc announcement pursuant to Article 53 of the SIX Exchange Regulation Listing Rules)

ZURICH–(BUSINESS WIRE)–Regulatory News:

UBS (NYSE:UBS) (SWX:UBSN):

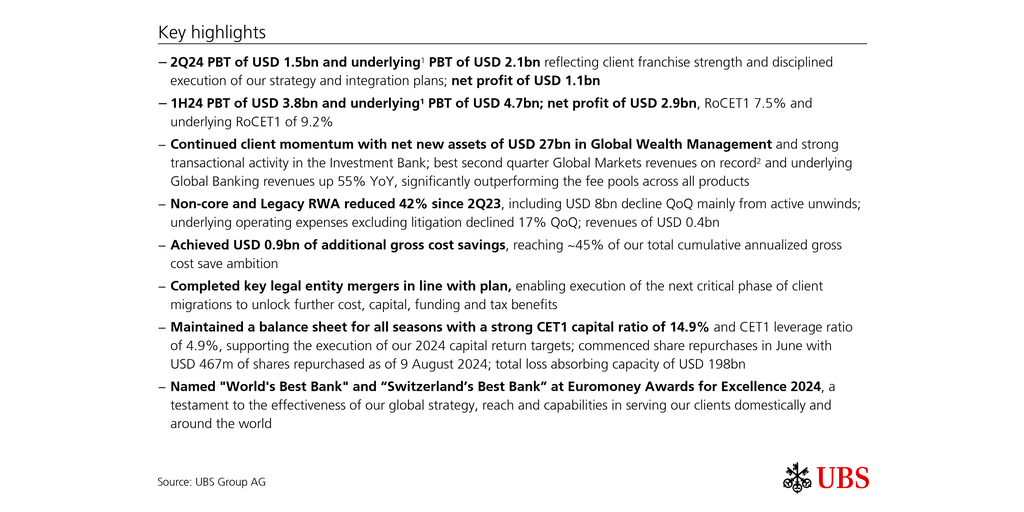

Key highlights

- 2Q24 PBT of USD 1.5bn and underlying1 PBT of USD 2.1bn reflecting client franchise strength and disciplined execution of our strategy and integration plans; net profit of USD 1.1bn

- 1H24 PBT of USD 3.8bn and underlying1 PBT of USD 4.7bn; net profit of USD 2.9bn, RoCET1 7.5% and underlying RoCET1 of 9.2%

- Continued client momentum with net new assets of USD 27bn in Global Wealth Management and strong transactional activity in the Investment Bank; best second quarter Global Markets revenues on record2 and underlying Global Banking revenues up 55% YoY, significantly outperforming the fee pools across all products

- Non-core and Legacy RWA reduced 42% since 2Q23, including USD 8bn decline QoQ mainly from active unwinds; underlying operating expenses excluding litigation declined 17% QoQ; revenues of USD 0.4bn

- Achieved USD 0.9bn of additional gross cost savings, reaching ~45% of our total cumulative annualized gross cost save ambition

- Completed key legal entity mergers in line with plan, enabling execution of the next critical phase of client migrations to unlock further cost, capital, funding and tax benefits

- Maintained a balance sheet for all seasons with a strong CET1 capital ratio of 14.9% and CET1 leverage ratio of 4.9%, supporting the execution of our 2024 capital return targets; commenced share repurchases in June with USD 467m of shares repurchased as of 9 August 2024; total loss absorbing capacity of USD 198bn

- Named “World’s Best Bank” and “Switzerland’s Best Bank” at Euromoney Awards for Excellence 2024, a testament to the effectiveness of our global strategy, reach and capabilities in serving our clients domestically and around the world

“Our first-half results reflect the significant progress we have made since the closing of the acquisition as we deliver on all of our commitments to stakeholders. We are well positioned to meet our financial targets and return to the levels of profitability we delivered before being asked to step in and stabilize Credit Suisse. We are now entering the next phase of our integration, which will be critical to realize further substantial cost, capital, funding and tax benefits. As we execute on our plans, we will continue to invest to position UBS for sustainable growth while staying close to clients, providing even better outcomes for them and the communities where we live and work.” Sergio P. Ermotti, Group CEO

Selected financials for 2Q24

| Profit before tax 1.5 USD bn | Cost/income ratio 86.9 % | RoCET1 capital 5.9 % | Net profit 1.1 USD bn | CET1 capital ratio 14.9 % |

| Underlying1 2.1 USD bn | Underlying1 80.6 % | Underlying1 8.4 % | Diluted 0.34 USD | CET1 4.9 % |

| Information in this news release is presented for UBS Group AG on a consolidated basis unless otherwise specified.

1 Underlying results exclude items of profit or loss that management believes are not representative of the underlying performance. Underlying results are a non-GAAP financial measure and alternative performance measure (APM). Refer to “Group Performance” and “Appendix-Alternative Performance Measures” in the financial report for the second quarter of 2024 for a reconciliation of underlying to reported results and definitions of the APMs. 2 Since 2013. | ||||

Group summary

Delivered strong performance in a complex market environment

In 2Q24, we reported PBT of USD 1,469m and underlying PBT of USD 2,060m. Net profit attributable to shareholders was USD 1,136m and return on CET1 capital was 5.9%, or 8.4% on an underlying basis.

Reported revenues were USD 11.9bn. Underlying revenues were USD 11.1bn, 7% lower sequentially against a strong 1Q24, largely driven by NCL and with strong capital markets activity partially offsetting anticipated net interest income headwinds. Reported Group operating expenses increased 1% QoQ to USD 10,340m and included litigation-related releases of USD 150m. On an underlying basis, operating expenses decreased 3% QoQ to USD 8,969m as we continued to execute our cost reduction initiatives. Excluding the aforementioned litigation-related releases, the sequential underlying decrease was 1%.

Demonstrating continued franchise strength

Clients continue to place trust and value in UBS’s strength, stability and advice as evidenced by USD 27bn in net new assets in GWM with positive inflows across all regions, and after absorbing headwinds from around USD 6bn of seasonal tax outflows in the US as well as outflows related to our ongoing balance sheet optimization efforts. Net new fee generating assets were USD 16bn. Net new assets in 1H24 were USD 54bn, on track to deliver on our guidance of USD ~100bn of NNA per annum through 2025.

Transactional activity was strong in the quarter, especially among institutional clients. In GWM we delivered transaction-based revenues of more than USD 1bn, with strong momentum in APAC and the Americas, as we continue to provide our wealth management clients with best-in-class access to our Investment Bank’s advice, products and execution capabilities. In Global Markets, we delivered our best second quarter results on record since 2013 with revenues up 18% YoY. Underlying Global Banking revenues were up 55% YoY as we significantly outperformed the fee pools across all products without compromising on our risk and capital discipline.

In July, UBS was awarded “World’s Best Bank” in the Euromoney Awards for Excellence 2024, affirming the effectiveness of our longstanding strategy centered around our truly global wealth management franchise and leading Swiss universal bank, which enabled the successful rescue and ongoing integration of Credit Suisse while we continue to deliver best-in-class services and advice to our clients. We were also proud to be named “Switzerland’s Best Bank” for the tenth time since 2012, reflecting our global reach and capabilities to support our Swiss clients and economy. Since the acquisition, clients have entrusted us with around CHF 30bn in net new deposits and with around CHF 85bn3 of loans granted or renewed since the acquisition, we currently extend around CHF 350bn of loans to Swiss clients.

Steady progress on balance sheet and cost reductions with delivery of key integration milestones

We are executing our integration plan, and continue to deliver on all of our commitments.

We reduced Group RWA by USD 15bn QoQ, of which over USD 8bn from across the core business divisions, primarily as a result of the financial resource optimization work in GWM and P&C. We have also continued to run down the NCL portfolio at pace, with an RWA decrease of USD 8bn QoQ largely driven by active unwinds across a majority of portfolios, bringing the total RWA reduction in NCL to 42% compared to a year ago.

Group LRD decreased by USD 35bn QoQ, largely driven by the full repayment of the Emergency Liquidity Assistance central bank liquidity facility, in addition to lower lending volumes mainly from our financial resource management efforts and the active run-down of the NCL portfolio.

In 2Q24, we realized an additional USD 0.9bn in gross cost savings, for a total of USD ~6bn in annualized exit rate gross cost savings vs. FY22 combined. We now expect to achieve around USD 7bn of gross cost savings by end-2024, or around 55% of our ambition of USD ~13bn by end-2026.

We completed the merger of UBS AG and Credit Suisse AG on 31 May 2024, the transition to a single US intermediate holding company on 7 June 2024, and the merger of UBS Switzerland AG and Credit Suisse (Schweiz) AG on 1 July 2024. These crucial milestones have begun to support a more normalized tax rate and will facilitate the migration of clients onto UBS platforms, beginning in Singapore, Hong Kong and Luxembourg in the fourth quarter of 2024, which are critical steps to unlock the next phase of the cost, capital, funding and tax benefits we expect to realize by the end of 2026.

| 3 Loans to privates, corporates and public institutions in P&C and GWM Switzerland, from 1.6.23 to 30.6.24 |

Maintained capital strength and a balance sheet for all seasons

The CET1 capital ratio was 14.9% and the CET1 leverage ratio was 4.9%, supporting the execution of our 2024 capital return targets. We continue to target up to USD 1bn of share repurchases in 2024, which we commenced in June with USD 467m of shares repurchased as of 9 August 2024. We also maintained healthy liquidity buffers with an LCR of 212% and an NSFR of 128%.

Following the merger of UBS AG and Credit Suisse AG, UBS AG’s standalone CET1 capital ratio as of 30 June 2024 is expected to be around 13.5% on a fully applied basis, and around 100 basis points above our current fully applied requirement by 2030. Final capital figures for UBS AG standalone will be published with our Pillar 3 report, which will be available as of 23 August 2024.

Outlook

The macroeconomic outlook continues to be clouded by ongoing conflicts, other geopolitical tensions and the upcoming US elections. We expect these uncertainties to persist for the foreseeable future, and they will likely lead to higher market volatility compared with the first half of the year.

Entering the third quarter, we are seeing positive investor sentiment and continued momentum in client and transactional activity. Also visible are moderate net interest income headwinds from ongoing mix shifts in Global Wealth Management and the effects of the second Swiss National Bank rate cut, not yet captured in our deposit pricing in Personal & Corporate Banking.

As we execute our integration plans, we expect to incur in the third quarter of 2024 around USD 1.1bn of integration-related expenses, while the pace of gross cost savings will decline modestly sequentially. Integration-related expenses should be partly offset by around USD 0.6bn accretion of purchase accounting effects.

For the second half of 2024, we estimate Non-core and Legacy will record an underlying pre-tax loss of around USD 1bn as revenues are expected to reflect moderate short-term upside to current book values and continued sequential progress on costs. In the absence of a better-than-expected reported Non-core and Legacy performance, we continue to expect our effective tax rate for the second half of 2024 to be around 35%.

Our diversified business model positions us well to deliver sustainable long-term value for shareholders across various market conditions. We remain focused on supporting our clients while positioning the Group for future growth.

Second quarter 2024 performance overview – Group

This discussion and analysis of results compares the second quarter of 2024, which covers three full months of post-acquisition results, with the second quarter of 2023, which included only one month of post-acquisition results.

Group PBT USD 1,469m, underlying PBT USD 2,060m

PBT of USD 1,469m included PPA effects and other integration items of USD 780m and integration-related expenses and PPA effects of USD 1,372m. Underlying PBT was USD 2,060m, including net credit loss expenses of USD 95m. The cost/income ratio was 86.9% and the underlying cost/income ratio was 80.6%. Net profit attributable to shareholders was USD 1,136m, with diluted earnings per share of USD 0.34. Return on CET1 capital was 5.9%, and 8.4% on an underlying basis.

Global Wealth Management (GWM) PBT USD 871m, underlying PBT USD 1,161m

Total revenues increased by 15% to USD 6,053m, largely driven by the consolidation of Credit Suisse revenues for the full quarter. Excluding PPA effects and other integration items of USD 233m, underlying total revenues were USD 5,820m. Net credit loss releases were USD 1m, compared with net expenses of USD 149m in the second quarter of 2023. Operating expenses increased by 27% to USD 5,183m, largely due to the consolidation of Credit Suisse expenses for the full quarter and an increase in financial advisor compensation reflecting higher compensable revenues. Excluding integration-related expenses and PPA effects of USD 523m, underlying operating expenses were USD 4,660m. The cost/income ratio was 85.6%, and 80.1% on an underlying basis. Invested assets increased by USD 15bn sequentially to USD 4,038bn. Net new assets were USD 26.9bn.

Personal & Corporate Banking (P&C) PBT CHF 703m, underlying PBT CHF 645m

Total revenues increased by 27% to CHF 2,061m, mainly due to the consolidation of Credit Suisse revenues for the full quarter. Excluding PPA effects and other integration items of CHF 223m, underlying total revenues were CHF 1,838m. Net credit loss expenses were CHF 92m, compared with net expenses of CHF 198m in the second quarter of 2023. Operating expenses increased by 51% to CHF 1,266m, largely due to the consolidation of Credit Suisse expenses for the full quarter. Excluding integration-related expenses and PPA effects of CHF 165m, underlying operating expenses were CHF 1,101m. The cost/income ratio was 61.4%, and 59.9% on an underlying basis.

Asset Management (AM) PBT USD 130m, underlying PBT USD 228m

Total revenues increased by 32% to USD 768m, mainly reflecting the consolidation of Credit Suisse revenues for the full quarter and included a USD 28m net gain from the initial portion of the sale of our Brazilian real estate fund management business. Operating expenses increased by 27% to USD 638m, mainly reflecting the consolidation of Credit Suisse expenses for the full quarter. Excluding integration-related expenses of USD 98m, underlying operating expenses were USD 540m. The cost/income ratio was 83.0%, and 70.3% on an underlying basis. Invested assets increased by USD 10bn sequentially to USD 1,701bn. Net new money was USD (11.8bn), and USD (14.6bn) excluding money market flows and associates.

Investment Bank (IB) PBT USD 477m, underlying PBT USD 412m

Total revenues increased by 38% to USD 2,803m, due to higher Global Banking and Global Markets revenues. Excluding PPA effects of USD 310m, underlying total revenues were USD 2,493m. Net credit loss releases were USD 6m, compared with net expenses of USD 132m in the second quarter of 2023. Operating expenses increased by 15% to USD 2,332m, largely due to an increase in variable compensation relating to higher revenues. Excluding integration-related expenses of USD 245m, underlying operating expenses were USD 2,087m. The cost/income ratio was 83.2%, and 83.7% on an underlying basis. Return on attributed equity was 11.3%, and 9.7% on an underlying basis.

Non-core and Legacy (NCL) PBT USD (405m), underlying PBT USD (80m)

Total revenues were USD 401m, and reflected net gains from position exits, along with net interest income from securitized products and credit products. Net credit loss releases were USD 1m, compared with net expenses of USD 119m in the second quarter of 2023. Operating expenses were USD 807m. Excluding integration-related expenses of USD 325m, underlying operating expenses were USD 481m.

Group Items PBT USD (377m), underlying PBT USD (371m)

UBS’s sustainability highlights

Support for Swiss communities affected by the recent storms

Earlier this summer the cantons of Ticino, Valais and Graubünden were hit hard by severe storms. Thousands of people had to evacuate their homes, some even lost their lives, and communities are facing significant and costly damage.

UBS supported the dedicated Unwetter-Fond (severe weather fund) launched by the Schweizer Patenschaft für Berggemeinden which provides support and resources for clean-up and reconstruction as well as vital capital for preventive measures. Thanks to the generosity of clients and employees approximately CHF 800,000 were raised for the fund, including a CHF 400,000 UBS donation and match funding.

Developing the next generation of talent

Our commitment to attract, develop and retain top talents is a key component of our sustainable performance. Importantly, we have maintained our structured job entry training programs (e.g., apprenticeships, interns and graduates) at the same level as UBS and Credit Suisse combined before the integration. Across UBS, we have around 4,000 junior talents including around 2,300 in Switzerland, and many of them are starting their career this summer. We continue to be fully dedicated to our development programs and are constantly evaluating new ways to prepare the next generation of talent.

UBS donates USD 25m to celebrate the UBS Optimus Foundation 25th anniversary

We are proud of the work done by the UBS Optimus network of foundations and the difference they make to millions of lives every year. Over the past 25 years, the UBS Optimus Foundation has grown from a small grant-making organization to a network of foundations that drive transformative, scalable impact change for marginalized communities globally and locally. During this time, Optimus has raised over USD 1.5bn in donations together with our clients and employees, and in the last year alone our current Optimus programs reached 6.7m people.

To recognize this important milestone, UBS has donated USD 25m to provide a 25% match for donations made to the UBS Optimus Foundation Anniversary Impact Appeal. The funds raised will be used to accelerate the work of four transformative initiatives in the areas of education, health and the environment across Africa, Asia and South America.

A growing focus on Nature Finance

Nature Finance is a topic of growing interest for our clients and we recently held our first Nature Finance Conference to share insights on the key trends and discuss how to drive much-needed action. The event brought together leaders from academia, NGOs and intergovernmental organizations, as well as UBS experts and clients, to discuss the critical role nature plays in our economy and how to unlock greater pools of capital to benefit the natural world.

UBS Asset Management and Planet Tracker launched a guide for investors aimed at maximizing investment in new energy solutions while minimizing their impacts on nature. The guide sets out strategies to support decision makers at every stage of planning, financing and implementation.

UBS Global Wealth Management has joined forces with Rockefeller Asset Management (RAM) to provide clients with exposure to multiyear growth prospects in areas such as wastewater treatment, waste management and plastic recycling, and sustainable aquaculture. The fund focuses on around 50 high conviction small- and mid-cap “improver” stocks, building on GWM’s award-winning CIO research and the ocean expertise of RAM.

| Selected financial information of the business divisions and Group Items | ||||||||

|

| For the quarter ended 30.6.24 | |||||||

| USD m | Global Wealth Management | Personal & Corporate Banking | Asset Management | Investment Bank | Non-core and Legacy | Group Items |

| Total |

| Total revenues as reported | 6,053 | 2,272 | 768 | 2,803 | 401 | (392) |

| 11,904 |

| of which: PPA effects and other integration items1 | 233 | 246 |

| 310 |

| (8) |

| 780 |

| Total revenues (underlying) | 5,820 | 2,026 | 768 | 2,493 | 401 | (384) |

| 11,124 |

| Credit loss expense / (release) | (1) | 103 | 0 | (6) | (1) | 0 |

| 95 |

| Operating expenses as reported | 5,183 | 1,396 | 638 | 2,332 | 807 | (15) |

| 10,340 |

| of which: integration-related expenses and PPA effects2 | 523 | 182 | 98 | 245 | 325 | (2) |

| 1,372 |

| Operating expenses (underlying) | 4,660 | 1,213 | 540 | 2,087 | 481 | (13) |

| 8,969 |

| Operating profit / (loss) before tax as reported | 871 | 773 | 130 | 477 | (405) | (377) |

| 1,469 |

| Operating profit / (loss) before tax (underlying) | 1,161 | 710 | 228 | 412 | (80) | (371) |

| 2,060 |

|

| ||||||||

|

| For the quarter ended 31.3.24 | |||||||

| USD m | Global Wealth Management | Personal & Corporate Banking | Asset Management | Investment Bank | Non-core and Legacy | Group Items |

| Total |

| Total revenues as reported | 6,143 | 2,423 | 776 | 2,751 | 1,001 | (355) |

| 12,739 |

| of which: PPA effects and other integration items1 | 234 | 256 |

| 293 |

| (4) |

| 779 |

| Total revenues (underlying) | 5,909 | 2,166 | 776 | 2,458 | 1,001 | (351) |

| 11,960 |

| Credit loss expense / (release) | (3) | 44 | 0 | 32 | 36 | (2) |

| 106 |

| Operating expenses as reported | 5,044 | 1,404 | 665 | 2,164 | 1,011 | (33) |

| 10,257 |

| of which: integration-related expenses and PPA effects2 | 404 | 160 | 71 | 143 | 242 | 1 |

| 1,021 |

| Operating expenses (underlying) | 4,640 | 1,245 | 594 | 2,022 | 769 | (34) |

| 9,236 |

| Operating profit / (loss) before tax as reported | 1,102 | 975 | 111 | 555 | (46) | (320) |

| 2,376 |

| Operating profit / (loss) before tax (underlying) | 1,272 | 878 | 182 | 404 | 197 | (315) |

| 2,617 |

|

| ||||||||

|

| For the quarter ended 30.6.233 | |||||||

| USD m | Global Wealth Management | Personal & Corporate Banking | Asset Management | Investment Bank | Non-core and Legacy | Group Items | Negative goodwill4 | Total |

| Total revenues as reported | 5,261 | 1,810 | 583 | 2,036 | 162 | (313) |

| 9,540 |

| of which: PPA effects and other integration items1 | 186 | 143 |

| 55 |

| (6) |

| 378 |

| Total revenues (underlying) | 5,075 | 1,667 | 583 | 1,981 | 162 | (306) |

| 9,162 |

| Negative goodwill |

|

|

|

|

|

| 27,264 | 27,264 |

| Credit loss expense / (release) | 149 | 221 | 1 | 132 | 119 | 2 |

| 623 |

| Operating expenses as reported | 4,085 | 933 | 503 | 2,025 | 536 | 403 |

| 8,486 |

| of which: integration-related expenses and PPA effects2 | 68 | 37 | 14 | 161 | 105 | 348 |

| 732 |

| of which: acquisition-related costs |

|

|

|

|

| 106 |

| 106 |

| Operating expenses (underlying) | 4,017 | 896 | 489 | 1,864 | 432 | (51) |

| 7,648 |

| Operating profit / (loss) before tax as reported | 1,028 | 655 | 79 | (121) | (493) | (717) | 27,264 | 27,695 |

| Operating profit / (loss) before tax (underlying) | 909 | 549 | 93 | (14) | (388) | (257) |

| 891 |

| 1 Includes accretion of PPA adjustments on financial instruments and other PPA effects, as well as temporary and incremental items directly related to the integration. 2 Includes temporary, incremental operating expenses directly related to the integration, as well as amortization of newly recognized intangibles resulting from the acquisition of the Credit Suisse Group. 3 Comparative-period information has been restated for changes in business division perimeters, Group Treasury allocations and Non-core and Legacy cost allocations. Refer to “Note 3 Segment reporting” in the “Consolidated financial statements” section of the UBS Group second quarter 2024 report and to “Changes to segment reporting in 2024” in the “UBS business divisions and Group Items” section and the “Equity attribution” section of the UBS Group first quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information. 4 Comparative-period information has been revised. Refer to “Note 2 Accounting for the acquisition of the Credit Suisse Group” in the “Consolidated financial statements” section of the UBS Group second quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information.

| ||||||||

| Selected financial information of the business divisions and Group Items (continued) | ||||||||

|

| Year-to-date 30.6.24 | |||||||

| USD m | Global Wealth Management | Personal & Corporate Banking | Asset Management | Investment Bank | Non-core and Legacy | Group Items |

| Total |

| Total revenues as reported | 12,196 | 4,695 | 1,543 | 5,554 | 1,402 | (747) |

| 24,642 |

| of which: PPA effects and other integration items1 | 467 | 502 |

| 603 |

| (12) |

| 1,559 |

| Total revenues (underlying) | 11,729 | 4,193 | 1,543 | 4,951 | 1,402 | (735) |

| 23,083 |

| Credit loss expense / (release) | (4) | 146 | 0 | 26 | 35 | (2) |

| 201 |

| Operating expenses as reported | 10,228 | 2,800 | 1,303 | 4,496 | 1,818 | (48) |

| 20,597 |

| of which: integration-related expenses and PPA effects2 | 928 | 342 | 169 | 387 | 568 | (1) |

| 2,392 |

| Operating expenses (underlying) | 9,300 | 2,458 | 1,134 | 4,109 | 1,250 | (47) |

| 18,205 |

| Operating profit / (loss) before tax as reported | 1,972 | 1,748 | 241 | 1,032 | (451) | (698) |

| 3,844 |

| Operating profit / (loss) before tax (underlying) | 2,433 | 1,588 | 410 | 816 | 117 | (687) |

| 4,677 |

|

| ||||||||

|

| Year-to-date 30.6.233 | |||||||

| USD m | Global Wealth Management | Personal & Corporate Banking | Asset Management | Investment Bank | Non-core and Legacy | Group Items | Negative goodwill4 | Total |

| Total revenues as reported | 10,049 | 3,087 | 1,086 | 4,401 | 185 | (524) |

| 18,284 |

| of which: PPA effects and other integration items1 | 186 | 143 |

| 55 |

| (6) |

| 378 |

| Total revenues (underlying) | 9,863 | 2,943 | 1,086 | 4,346 | 185 | (517) |

| 17,906 |

| Negative goodwill |

|

|

|

|

|

| 27,264 | 27,264 |

| Credit loss expense / (release) | 164 | 237 | 1 | 139 | 119 | 2 |

| 662 |

| Operating expenses as reported | 7,646 | 1,597 | 911 | 3,891 | 1,235 | 416 |

| 15,696 |

| of which: integration-related expenses and PPA effects2 | 68 | 37 | 14 | 161 | 105 | 348 |

| 732 |

| of which: acquisition-related costs |

|

|

|

|

| 176 |

| 176 |

| Operating expenses (underlying) | 7,578 | 1,560 | 897 | 3,730 | 1,130 | (108) |

| 14,787 |

| Operating profit / (loss) before tax as reported | 2,239 | 1,253 | 174 | 372 | (1,169) | (942) | 27,264 | 29,191 |

| Operating profit / (loss) before tax (underlying) | 2,121 | 1,147 | 188 | 478 | (1,064) | (412) |

| 2,457 |

| 1 Includes accretion of PPA adjustments on financial instruments and other PPA effects, as well as temporary and incremental items directly related to the integration. 2 Includes temporary, incremental operating expenses directly related to the integration, as well as amortization of newly recognized intangibles resulting from the acquisition of the Credit Suisse Group. 3 Comparative-period information has been restated for changes in business division perimeters, Group Treasury allocations and Non-core and Legacy cost allocations. Refer to “Note 3 Segment reporting” in the “Consolidated financial statements” section of the UBS Group second quarter 2024 report and to “Changes to segment reporting in 2024” in the “UBS business divisions and Group Items” section and the “Equity attribution” section of the UBS Group first quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information. 4 Comparative-period information has been revised. Refer to “Note 2 Accounting for the acquisition of the Credit Suisse Group” in the “Consolidated financial statements” section of the UBS Group second quarter 2024 report, available under “Quarterly reporting” at ubs.com/investors, for more information.

| ||||||||

Contacts

UBS Group AG

Investor contact

Switzerland: +41-44-234 41 00

Americas: +1-212-882 57 34

Media contact

Switzerland: +41-44-234 85 00

UK: +44-207-567 47 14

Americas: +1-212-882 58 58

APAC: +852-297-1 82 00