Unlocking Prosperity: Unipe’s Bold Mission to Build a Credit Universe for MSMEs and its Workforce

Meet Raj, the owner of a bustling manufacturing unit in the heart of India. His factory, a microcosm of the nations robust economy, employed over 200 skilled workers. Raj took pride in contributing to Indias growth story, but behind the scenes, he faced a persistent challenge-processing payroll on time.

|

Unipe – Payroll Finance

In a country with a workforce exceeding 500 million, payroll complexities are not just numbers on a ledger; theyre the lifeblood of every family. For Raj, ensuring timely payouts of an average of INR 15,000 per person per month became a daunting task. The ebb and flow of his factorys cash flow often created hurdles, resulting in delayed salary payouts, diminishing worker morale, and an operational capacity below its true potential.

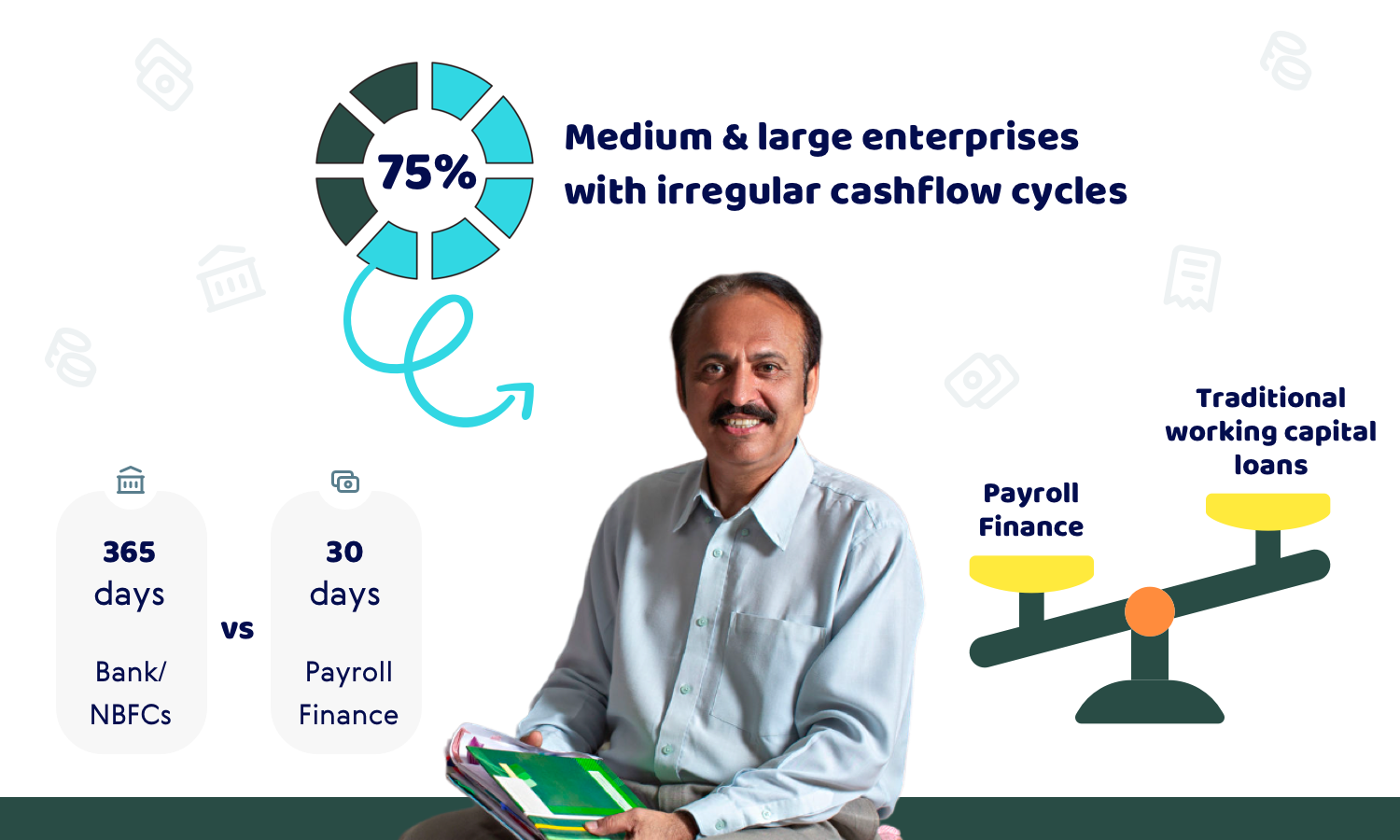

The Striking Reality: $75 Billion in Payout Delays

As Raj grappled with these challenges, he discovered a beacon of hope in Unipe, a revolutionary force in payroll finance in India. Unipes innovative software stood at the forefront, reshaping the financial landscape and empowering 200 million formally employed Indian workers across the country.

How Unipe Works Its Magic

On Rajs side, Unipes software platform offered payroll financing as its flagship product. It addressed challenges like delayed salary payouts and the working capital crunch associated with early pay requests. By seamlessly integrating into Rajs workforce management and business workflows, Unipe ensured a smooth experience for processing salaries and managing people operations.

Beyond payroll financing, Unipe enriched its value proposition with features like digital onboarding, automated compliance, and seamless remittance. This comprehensive approach allowed businesses not only to guarantee timely salary payments but also to streamline onboarding, automate compliance tasks, and simplify the remittance process.

Unipes Winning Formula

“Unlike traditional banks and NBFCs struggling with yearly asset cycles and sluggish underwriting, Unipe thrived on predictive analytics. The recurring nature of payroll finance provided quick feedback, enabling Unipe to grow confidently with clear predictions and build robust client relationships,“says Abhijit Verma, Co-founder & VP, Finance.

On the employer side, Unipe software platform offers payroll financing as its primary product, addressing challenges such as delayed salary payouts and working capital crunch associated with early pay requests. By embedding into the workforce management and business workflow of employers, Unipe creates a seamless experience for processing salaries and managing people operations. In addition to payroll financing, Unipe also provides other features like digital onboarding, automated compliance, and seamless remittance. These features further enhance its value proposition for businesses, making it a comprehensive solution for managing people operations. With Unipe, businesses can not only ensure timely salary payments but also streamline their onboarding processes, automate compliance tasks, and simplify the remittance process. This integrated approach helps businesses save time and resources, allowing them to focus on their core operations. Overall, Unipes software platform offers a range of solutions to address the challenges faced by businesses in managing their payroll and people operations, making it a valuable tool for organisations of all sizes.

Unipes Remarkable Milestones

In just one year, Unipe boasted a $15 million annual disbursement run rate with a flawless track record-Zero Non-Performing Assets (NPA). The journey ahead is ambitious, covering aspects such as workforce management, compliance, taxes, and more. Unipe aims to expand its market reach significantly, aspiring to be the leading Credit Universe for MSMEs and its Workforce

Adding Value: The Future of Financial Inclusion

“Unipe doesnt just solve the problem of timely payroll; its at the forefront of a financial inclusion revolution in India. By empowering not only business owners like Raj but the very backbone of Indias economy-the workforce-Unipe is contributing to a future where financial services are accessible, efficient, and a catalyst for individual and national prosperity. The impact goes beyond business metrics; it touches the lives of millions, fostering economic growth and social well-being. Unipe envisions a future where every Indian worker has financial tools at their fingertips, seamlessly integrated into their work lives, ensuring prosperity for all,“saysSahil Arora, Co-founder & VP, Finance.

“In the dynamic landscape of Indias financial markets, the need for contextual lending products has never been more pronounced. Unipes innovative payroll finance solution isnt just a remedy for current challenges; its a testament to the essential role of tailored financial solutions in fostering growth and stability in todays diverse and evolving economic environment,” says Anupam Acharya, Co-founder & CEO at Unipe.

Are you ready to transform your business and empower your workforce with Unipes revolutionary payroll finance solution Connect us at [email protected] to unlock prosperity for your company and its employees. Dont miss the opportunity to be a part of the financial inclusion revolution in India!

![]() Disclaimer: This content is distributed by Newsvoir.

Disclaimer: This content is distributed by Newsvoir.